by Ugh

Just when the GOP is getting ready to drop their huge (yuuuuge!) plans for tax reform on Wednesday, Mueller drops his first indictment: of Paul Manafort for….tax fraud! Or at least failing to file FBAR reports.

You can't make this sh1t up.

Perhaps the GOP proposal can be labeled tax fraud, instead of tax reform, and it will die.

In other news, I picked a hell of a week to stop sniffing glue.

Whee.

Brian S. Fraser

all the kids want something to do

Paul Ryan is doing his “we will keep working on reforming the tax code on behalf of the American people” thing.

Ryan knows better than to criticize Papa Donald in front of the kids.

Let me remind one and all:

1) “Tax cut” doesn’t mean YOU get to pay less. Beware of details.

2) A tax cut for people who are NOT you, while your tax bill stays the same (if you’re lucky), means that you get to pay a bigger fraction of total federal revenue than you were paying before.

3) If everybody, including you, gets to pay less, then either:

3a) your share of the “national” debt increases, or

3b) The Guvmint cuts spending on stuff that benefits people (including, with your luck, you.

4) Clinton raised taxes in the face of unanimous prophecies from the GOP of doom for The Economy, and both The Economy and The Guvmint prospered.

5) Dick and Dubya cut taxes (temporarily they said, but they were lying of course) and The Economy muddled listlessly along, until it crashed.

6) Obama (eventually) raised taxes again, and The Economy steadily improved. Corporate profits and stock prices rose steadily, but evidently not enough for corporations to “create jobs” for the disaffected “white working class”. Corporations must need more money.

7) The GOP is always working diligently to solve the two main problems in America, namely that the poor have too much money and the rich don’t have enough. Tax cuts for the rich, “entitlement” cuts for the poor — that’s the ticket!

–TP

What are federal sentencing guidelines like these days? Are the money-laundering amounts large enough that these guys would go into the general prison population instead of one of the more comfortable low-security facilities?

My working assumption would be that these guys all knew they’d done illegal stuff that would be uncovered if someone with resources started digging. Why would they attach themselves to a Presidential campaign? Did Trump tell them, “I don’t want to be President, it’s all a publicity stunt”?

Just read that a single one of Manafort’s charges could carry a 12 year prison sentence. Looks like he is s.t. home confinement, surrender passport, and 10 million bail.

@ TP:

All good points. As someone who has a significant investment portfolio, I fared significantly better under Clinton and Obama than I did under Bush. Even viewed through the narrow lens of financial self-interest, competent leadership is better than tax cuts.

Obama (eventually) raised taxes again

Using Wikipedia

a) First, he cut taxes in 2009, $288 billion

b) As usual, more credit has to go to Congress, Obama just signs the bills, but, to quote:

“It extended the Bush tax cuts for roughly the bottom 99% of income earners (those earning below $400,000, or $450,000 for married couples).”

“Stated another way, it extended roughly 80% of the Bush tax cuts indefinitely.”

“Bottom 99%” is interesting phrasing, but on balance it is a little disingenuous to say Obama raised taxes. It would be like saying “All Americans are in the Army” when it is only 1% of Americans. To a vast degree, Obama and Congress made the temporary Bush tax cuts permanent for everybody. Forever, I expect.

bob,

I implore you to tell the Martys and McKinneys of this blog that “it is a little disingenuous to say Obama raised taxes”. Never mind imploring, I double-dawg-dare-ya.

–TP

I think it is important to treat the tax cut proposals as what they are – a giveaway to the wealthy – in other words, a terrible idea.

It is a trap to look at economic consequences, vaguely defined benefits to the whole country, etc. As, I am quite certain though I don’t have a cite at hand, Sun Tzu said, it is a disastrous mistake to fight on the enemy’s ground.

The more I read, the more it looks like the Papadopolous plea bargain may end up being a bigger deal than the Manafort indictment. Including the fact that it may help to flip Manafort.

A fun detail about tax cuts. something called “statutory PAYGO” says that if all of the bills passed by the end of the current calendar year have the net effect of increasing deficits, then automatic, immediate, offsetting cuts to certain non-discretionary spending programs — including Medicare — go into effect.

So, if Congress successfully passes a $1.5 trillion tax cut before going home for Christmas, $28 billion would get automatically slashed from Medicare between January and September of next year. And that’s just in Medicare. Other popular programs, such as mandatory spending on student loan administration and farm subsidies, would be wiped out entirely.

Brilliant! Do something that will slash Medicare and then somehow your core over-65 demographic will embrace you for cutting taxes. Riiiiiiight.

“Stated another way, it extended roughly 80% of the Bush tax cuts indefinitely.”

I’m confused. Isn’t this just another way of saying he wiped out 20% of the Bush tax cuts (i.e., raised taxes)?

the more it looks like the Papadopolous plea bargain may end up being a bigger deal than the Manafort indictment. Including the fact that it may help to flip Manafort.

Think of them more as as carrot and stick…

Co-operate, like this self-confessed criminal, who is already singing, and you’ll make out OK; hold out on us, and you’re looking at the business end of 30 years.

And by the way forget presidential pardons – where the money is concerned, we’ve a couple of state AGs quite happy to bring charges…

“Do something that will slash Medicare and then somehow your core over-65 demographic will embrace you for cutting taxes. Riiiiiiight.”

Before I was in the core over-65 demographic, in other words, while I was passing through every OTHER age demographic we boomers have watched whiz by at the speed of light, I’ve read about and known that the conservative movement, bankrolled by radicals, is dedicated to and will roll back completely every gummint program, most certainly Medicare, touched by liberals since the New Deal.

Because they tell us so. Daily. Through bullshithorns.

Paul Ryan’s favorite book is NOT the English Poor Law of 1601.

Student loan administration and farm subsidies will be mere road kill along the way.

Cutting the inflow of revenue to the government has as its end game vaporizing government. That we are once again going through this kabuki that tax cuts will increase government revenue, as if any of the current brand of conservative jacobins would find THAT to be some sort of favorable accidental, but virtuous consequence of tax cuts, and that any of it is a “surprise” to the present “over-65 core demographic” may get to the root of why America, to its core, is completely full of shit, because we don’t get it.

Tara Ann Roe

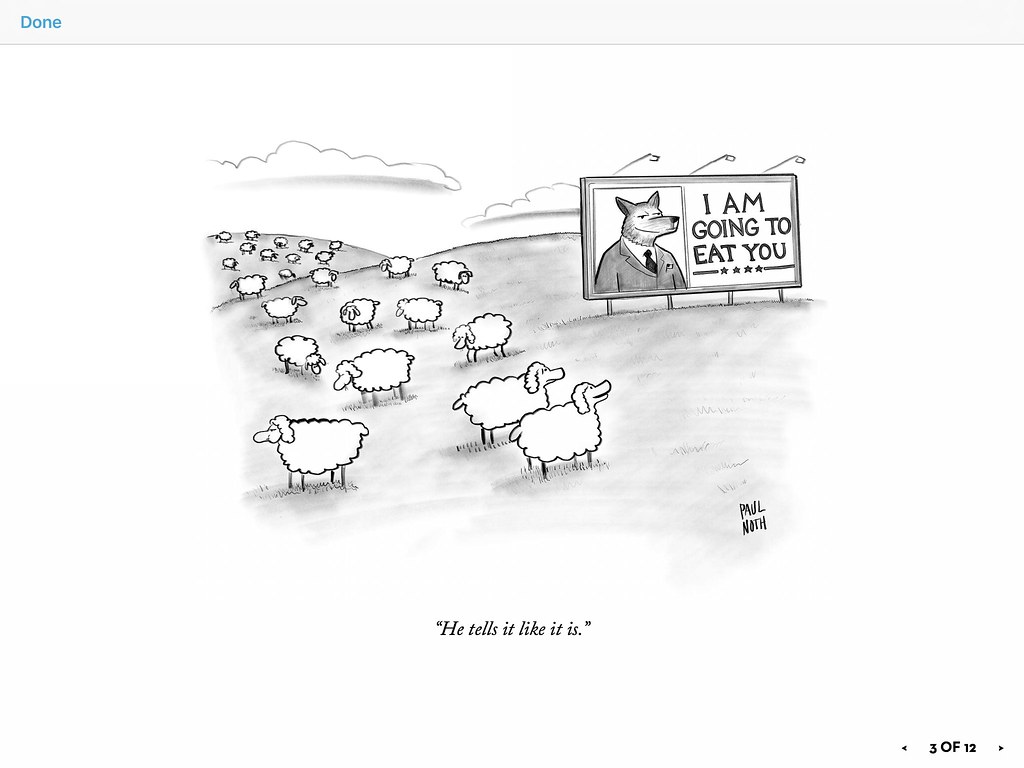

Because they tell us so. Daily.

Trump told us so during the campaign. This used to be funny, now not so much:

It’s so long since I learned cleek’s method for posting images, I hope this works properly. If not, link is:

https://c1.staticflickr.com/9/8205/29160592045_16476407c5_b.jpg

I’ve read about and known that the conservative movement, bankrolled by radicals, is dedicated to and will roll back completely every gummint program, most certainly Medicare, touched by liberals since the New Deal.

Sure, they (especially the more radical ones) would love to do exactly that. But if they manage to get the rest of the GOP to sign on to their suicide pact, your dream of the GOP disappearing in a blaze of non-glory may well come through. Because if they lose the over-65 crowd, they’ve got nothing left.

I suppose the question is, will they manage to obscure that little “feature” of their tax cut plans long enough to get it passed? Or will the get a chance to see if failing to pass a massive tax cut for the rich really will get them voted out of office? Fun times to be a GOP Congressman!

i actually learned something from FoxNews!

it’s a small, scummy, world.

Tax cuts AND robots. AND nobody is talking about it, it is claimed. We should rename OBWI: The Talking Nobodies.

http://www.theamericanconservative.com/dreher/here-come-the-robots-artificial-intelligence-revolution/

why?

because people are still telling each other horror stories about how the economy is the worst ever. left and right, everybody is convinced that the economy sucks. and the GOP hucksters are taking advantage of that to pass another unnecessary budget-busting tax cut because the rich want to be richer.

they remain the dumbest assholes around.

here is what i think about taxes.

americans live in a permanent state of cognitive dissonance about what they want their government to do, and how that is actually going to be funded.

e.g., we are about to embark on a global war against an enemy that threatens our very existence, and we need tax cuts. oh, and everyone should go shopping.

as one simple example.

anyone who runs for public office on a platform based on shining even the dimmest 30w bulb version of the light of reality on this contradiction is going to lose.

flail away, america.

Maybe if more people understood that they wouldn’t be able to trust a fncking can of peas, let alone an automobile or a real-estate agent, with the government, they wouldn’t mind paying taxes. Or, more precisely, whether they realize it or not, they wouldn’t mind people with a sh1tload more money paying taxes.

without the government, that is.

Completely off topic, but I keep running into ads on the internet touting supplement grifter and housing and urban development know-nothing Dr. Ben Carson’s claims about his “research” into tripling the memory capacity of the human brain.

First:

https://www.google.com/search?q=ben+carson%27s+research+clai%2Cs+to+triple+memory&ie=utf-8&oe=utf-8

Second:

I look forward to his testimony in front of Congress and the FBI regarding what he remembers about the rump Administration’s successful campaign to steal the 2016 elections and the massive corruption that is occurring in our government since that election was held.

I suspect “I cannot recall that conversation” and “I don’t remember that incident” and taking the 5th will figure prominently, though maybe he will preface by saying he hadn’t taken his memory pills that day, therefore his memory is only one third of what it was just …. never.

I favor sticking an electrode into his hippocampus to confirm his theories.

http://theweek.com/articles/733687/anybody-actually-asking-tax-cuts

Good company Manafort has kept.

https://www.dailykos.com/stories/2017/10/31/1711218/-Fun-Fact-All-of-Paul-Manafort-s-previous-clients-fled-their-countries-in-ignominy-and-disgrace

Who is that Pence guy?

Running the government like a business, promoting from the mail room, and spreading conservative principles throughout.

Papadopoulos: coffee boy

http://talkingpointsmemo.com/livewire/michael-caputo-papadopoulos-coffee-boy

Papadopoulos: Do my colleagues mind of I dunk at the table? Jeff?

https://www.balloon-juice.com/2017/10/30/open-thread-be-sure-thy-sins-will-find-thee-out/

Lewandowski the other day: Papa whomaomao?

Lewandowski today: Pass me the memory supplements.

http://talkingpointsmemo.com/livewire/report-lewandowski-was-trump-official-papadopoulos-emailed-russia-trip

I agree that Americans live in a state of cognitive dissonance.

They have been told for decades that their 15%, 7.5% from them and 7.5% (or so) from their employers was going to pay for SS and Medicare.

In the next breath they are told that those programs are broke and need to be cut back to pay for other things in the budget.

Then they are told that the income taxes should go up to pay for something that they have already paid for, or if taxes are cut those things will be automatically cut.

At which point they go, what the Fnck does the income tax rate have to do with things we pay for out of payroll taxes? And where did the money go?

I think the cognitive dissonance comes from having to Republicans and Democrats talk out of both sides of their mouth about “entitlements”.

Like entitlements in this case is not equal to shit we already paid for. Not a hand out, not free food or free money, not a safety net provided by other people. Its shit we paid for over, in my case, the last 46 years.

So whether Dems use it as an excuse to raise other taxes or Reps cut it to pay for other spending it just doesn’t compute.

But was he in Dallas in November 1963?

https://www.balloon-juice.com/2017/10/30/late-evening-open-thread-the-jfk-files-release-tells-us-that-hitler-was-seen-alive-in-colombia-in-1955-wait-what/

Who is that Pence guy?

You mean the Pence guy that Manafort persuaded Trump to select as his running mate? The Vice President? That “Pence guy”?

But was he in Dallas in November 1963?

The Hitler-in-Columbia thing may have been during the CIA’s LSD experiment phase.

Speaking of LSD, I’m reading “An Unsung Cat”, a biography of saxophonist Warne Marsh.

Like many guys of his (and other) generation(s), Marsh dabbled in pharmaceuticals. A solid weed smoker from age 13 or so.

He tried LSD but didn’t like it. Said it made the notes too far apart.

Re Marty at 12:58…

I worked for the permanent budget staff for a state legislature. Believe me when I tell you that when new members of the General Assembly showed up, they generally had little or no idea where the money came from or how it was spent. These were the people who were going to vote on the very complicated budget bill within three months (at that time, the bill itself ran to about 600 pages, almost all numbers, and the separate descriptive documentation to about 800).

A large part of staff’s job every other year was educating them. To expect the typical voter to understand any of the cash flows is stretching things.

He tried LSD but didn’t like it. Said it made the notes too far apart.

In pitch or across time? I need to know!!!

“To expect the typical voter to understand any of the cash flows is stretching things.”

True, but here’s the thing. I don’t expect them(us) to understand cash flow or the investment limitations or the relationships between the Treasuries that are being held and the overall debt, the interest accruing on both sides of the ledger, or anything else.

And none of that detail matters. The facts are 15% and not any other part of the budget should be discussed in the same paragraph.

Music never made any sense to me on LSD.

All of it, from Beethoven to Strawberry Fields Forever to TV commercial jingles sounded like endless noodling, tootling, and blatting, kind of like, well …. a Grateful Dead concert, but I repeat myself.

Stoplights, on the other hand, at empty intersections in the still middle of the night, their mechanisms clanging loudly as they changed over and over and over very, very slowly, were objects of profound aesthetic contemplation signifying deep truths.

I remember once, while on one of my few trips, getting sidetracked from the group I was “traveling” with and drawn into a line to play four square in front of a dorm and playing the most spectacular FOUR hours of acrobatic, nearly break-dancing quality four square I’d ever played.

Then to the student art gallery to see an exhibition and howling with laughter at the meaningful art, while everyone else seemed rather morose about the whole thing.

Then running into a buddy and the girl he was dating and, as it was Halloween, going with them to a costume party at a farm house outside of town, somehow letting them dress me up like the wizard Merlin, because I was apparently claiming to be Merlin, with robes and a wand and a pointy wizard hat and a fake stuffed animal owl pinned to my shoulder, while sitting up on the trunk of his convertible Austin Healy, holding my wizard hat on like Auntie Em headed for the root cellar during the hurricane, as we wound through the country roads of central Ohio.

I immediately fell into the role at the party and cast spells on everyone in a cracked voice, calling them “Wart”, after “Camelot”.

I ended up calling my buddy Mordred because he wanted to leave early. “Why, Mordred, do you seek to thwart the Kingdom and make me do things I do not want to do. Why?”

The next evening, my group of LSD sojourners from whom I had become separated, asked: “What happened to you?”

Me? Nothing. What happened to you guys?

That would be a tornado, not a hurricane. That Owsley windowpane tended to heighten weather conditions.

You acid heads. We played house parties in the mid 70’s and so we would set up in the front room, or the covered patio but whatever, tight quarters and big sound. (I played nothing, I was the roadie and sound man).

We played one night at a house that, it turns out, was being demolished the next day. So the owner had a house smashing party and provided sledgehammers, crowbars and spray paint for anyone who wanted to take a shot at a wall.

He, being of sound mind, hung out in the unattached garage outback and handed out the windowpane, to whoever wanted it.

Without going into detail, the first set was pretty mellow, but between the time we started the second set and we almost finished the first song, the second(or third) hit took hold and the spatial boundaries between rooms and furniture and equipment became blurred. We loaded out as fast as we ever had, moved the truck around behind the garage and went back to help destroy the house.

It was still standing in the morning to our surprise. And there was much less damage than everyone had thought we were making

The music was fine.

Music never made any sense to me on LSD.

All of it, from Beethoven to Strawberry Fields Forever to TV commercial jingles sounded like endless noodling, tootling, and blatting

And I almost never smoke pot without music, and loved LSD intermittently, exactly because it helped me find and follow structure and themes in music, especially classical and jazz.

Can anyone but a professional actually follow the sonata form in a Beethoven symphony or piano work? Follow it in a way that makes emotional sense, the satisfaction and perfection of a musical mandala or a geometrical proof?

Ain’t been anything better in my life than the Mahler Ninth on headphones on an early morning, tripping my guts out. Maybe Morrison scattng “Almost Independence Day” or Coltrane’s “India” or Raga Jogeshwari.

O mean, that’s why we are here, right? The only excuse we have?

The fcking and nuzzling and fighting and hugging and playing, well, my dogs do that better.

Dogs don’t do architecture, monuments of architectonics.

I agree there is no need for a tax cut on personal income, especially at the top rates. I’m fine with tax relief at the lower end. I don’t favor a tax increase either. I’d try three things:

1. Lowering the corporate rate to 15%.

2. Requiring every dollar earned in America by a corporate entity (corp, LLC, PC, LP, LLP) to be taxed in America, no matter what.

3. Change the holding period for capital gains from 1 year to 3 years.

The facts are 15% and not any other part of the budget should be discussed in the same paragraph.

Nonsense. $3T in excess tax collections over the last 25 years. Transferred to the Treasury in exchange for special notes that can’t be sold elsewhere, and pay 2% interest, said interest paid in still more special notes. Now that the Boomers are retiring that $3T has to be repaid, either by borrowing in the open market or by raising other kinds of taxes.

The Greenspan Commission’s plan in the early 1980s intentionally linked SS (the lion’s share of that 15%) to the rest of the government budget.

…either by borrowing in the open market or by raising other kinds of taxes.

I left out the third option of simply printing money.

Can anyone but a professional actually follow the sonata form in a Beethoven symphony or piano work?

I think the audience for whom that stuff was composed could. Some folks still can, probably not so many.

Then again, people used to listen to the Odyssey recited aloud. From memory, apparently.

I think the Iroquois still recite their origin story aloud, mostly from memory. It takes quite a while.

Our attention spans are much shorter nowadays.

I’d try three things

Those all seem reasonable to me.

Yes Michael, we should try to explain to 300 million people the sleight of hand where Greenspan did that. Or just recognize that the 3 trillion dollars is owed by the rest of the budget, make it a crisis and leave changing ss out of the solution, and quit talking about it.

Here is my solution from 2011.

https://nowadifferentview.wordpress.com/2011/06/28/living-in-fear-a-conservative-stance-to-raise-taxes/

It is truly a horribly serious CRISIS, that fancy papers in filing cabinets with dollar signs must be replaced with less-fancy greenish papers with dollar signs.

At least, in these modern times, THESE bits have to be moved to THOSE bits. Apocalypse, I tells ya.

When the US Treasury Dept. runs up a big enough debt that it won’t fit in the 640K memory in the antique 8086 that they use for that stuff, the entire global financial system will crash, won’t it?

Of course 2^(640*1024) is still pretty big. We might have a few more aeons of hyperinflation to go.

Marty seems to understand the GOP’s SS scam. “You working stiffs lent $3T to The Guvmint, but you’re not entitled to have it back because, hey, we already spent it.” If they tried that line on Chinese central bankers, Republicans would soon learn that not all lenders are as easily duped as the “white working class”. Incidentally, one way The Guvmint can keep taxes low (e.g. on high incomes, corps, and corpses) is to borrow money. And who keeps pushing for lower taxes when in control of The Guvmint?

Marty seems to have forgotten the great Lock Box debate between Al Gore and Dubya Bush. Gore was mocked for wanting to “lock box” The Guvmint’s surpluses so as to protect SS. The mocking was led by Dubya’s acolytes (including the “liberal” media) who insisted that The Guvmint was collecting more of “your money” than it needed for its next meal, and should cut your taxes big time. So Marty naturally spouts both-sides-do-it Broderist BS.

Meanwhile McKinney has three concrete suggestions:

Reasonable-sounding stuff, except:

1. We hear all the time that corporations already pay an “effective” rate that may be even lower than that, thanks to “loopholes”. Would McKinney preserve the “loopholes” AND lower the nominal rate? Or not? The corporations which do (and don’t) benefit from those are eager to know.

2. Ugh needs to weigh in on how LLCs, LPs and other “pass-through” businesses are taxed. All I can say is that the last time I was a partner (active, not limited, FWIW) there was no line on the partnership return like “Tax the partnership owes”. And for all the decades I have been a sole-prop “business”, same deal. “Pass-throughs” are called that for a reason: THEY DON’T PAY TAXES. Their tax rate of 0% is hard to “cut”. The owners/partners receive the profits as income, and pay personal rates on that personal income, just like wage slaves do. Does McKinney suggest that my personal income from my own business should be taxed at a lower rate than Russell’s income from somebody else’s business?

BTW, “earned in America” is a definition that McKinney is welcome to take a whack at. I get the impression that even honest CPAs and tax lawyers (let alone the ones who work the “loopholes” on behalf of the likes of GE) are hard-pressed to define it.

3. Assuming that McKinney means profits on assets held less than 3 years should be taxed as ordinary income, like gambling winnings, I have no quarrel with this. I do have a quibble: why 3 and not, say, 5 years?

I also can’t help mentioning, again, that capital transactions can be losses as well as gains, but I’m too tired to think through the implications of that right now.

Finally, I should add: my thanks to McKinney for not bringing up the “death tax”. Saves me some invective.

–TP

i always liked slarti’s idea.

corporations taxed at 0%

capital gains taxed at the same rate as regular income

income is income. if that’s what we’re going to tax, tax it all under the same rate regime.

McKinney could be suggesting with #2 to get rid of pass-through entities altogether, so that there is an entity level tax like there is on C-corps and then a tax on the shareholder when s/he receives a dividend or sells shares at a gain.

If he’s suggesting U.S. business income be taxed at some level – at the entity level for c-corps or the partnership/LLC member level for pass-throughs – the former is relatively easy the latter less so when there is a partnership/pass-through with foreign partners. It depends on the nature of the partnership’s business and the participation of the partner in that business. There should be a tax on income “effectively connected with a U.S. trade or business,” levied even on foreign partners, IIRC. There are obviously rules defining “effectively connected,” and are not all easy to apply.

The OECD has spent the past 4 years trying to come up with rules to tax income where “value is created” – which may be another way of saying “earned in America” as McTx notes (or not, he can clarify obviously). But what creates value? Take Apple – is it the technology (and if so, which part, software/hardware?), the marketing, the design, creating the value? Where is that value created? Needless to say there is no agreed upon approach despite 4 years of effort.

The U.S. tax system does, in general, a pretty good job of imposing taxes on income “earned in America,” with I would say one main exception: it allows corporations to make deductible payments (primarily interest, but also rents and royalties) to a wholly owned foreign parent or affiliate. This “strips” income out of the U.S. without the corporate group as a whole losing any $$ to taxes (because the payments can be made to an entity located in a no-tax jurisdiction).

This is generally known as “base stripping” or “base erosion” (base short for “tax base”) and other countries have done a much better job of combating this than the U.S. It is also the primary benefit of inverting your corporate headquarters because U.S. headquartered companies can’t do this w/o a U.S. tax. It would be simple to fix this and yet the GOP (and Democrats before them) have done nothing.

Anyway, I have no hope for a tax “reform” bill that is now delayed until a Thursday release.

Instead, we will see Bush III temporary tax cuts, IMHO.

The problem with setting the corporate rate at 0% is that people will stuff a bunch of income into a personally owned c-corp and then either (i) “borrow” funds from that c-corp to live off of; and/or (ii) borrow funds elsewhere using the c-corp stock as collateral (there are more tax rules preventing (i) than (ii)). Few do this now because of the double tax – once at the c-corp at 35% and another at the s/h level.

But if the rate is 0%, the opportunity for a great deal of tax free build up is there.

My not entirely tongue in cheek solution: Tax whatever and wherever, that makes someone “rich” at an extremely high above a reasonable asset level.

Tax collector, “I hear you applied for a $5million dollar loan. On what basis do you justify a bank taking such a risk”>

Rich asshole, “I haz assets.”

Tax collector, “Not anymore.”

Of course, if we structured public policy such that acquiring vast financial wealth is extremely unlikely to begin with, we wouldn’t have to have this discussion.

income is income

Decade after decade of tax law argues otherwise.

Lastly, what Ugh said.

So whether Dems use it as an excuse to raise other taxes or Reps cut it to pay for other spending it just doesn’t compute.

Might be on to something there, Marty.

But the fundamental problem with your overall frame is that an economy with a fiat currency and a freely floating exchange rate (check, that’s us) cannot collectively “save” for “future benefits” via tax jiggling (raising them or lowering them) or cutting spending now to have “more” spending in the future (most likely would make things worse).

The whole argument is about who gets what from the economy NOW. Don’t let anybody fool you otherwise.

There are competing frames about how dividing up the pie now will make things easier for future generations. Generally, they break along these lines:

1. Give rich people a bigger slice of pie now so they will invest and create the economic growth calculated to meet the future needs of retirees.

2. Split up the pied more equally to encourage spending; stepped up public investment in public goods to increase our common capital base to enable that same level of future prosperity.

The first one is a goddamn self serving lie.

It’s interesting to see some new arguments for dropping the corporate rate. Because the only ones I have heard being made elsewhere were all essentially: if we do this, companies will have more money to invest and so make the economy grow faster. Which completely ignores the number of companies already sitting on huge piles of cash. Which they aren’t investing, apparently because they don’t see any particularly attractive opportunities to do so. Giving them more cash to sit on seems unlikely to suddenly change that perspective.

I’d be okay with having lower personal income and corporate taxes, but think that capital gains tax rates should be HIGHER than income tax.

Just take the ($Sell-$Buy)/YearsHeld, and if the yield is above 5x that of Treasury bonds, then you pay 50% of the extra return. High speed trading gets a smackdown because the “YearsHeld” might be 5 microseconds.

Richy-riches can always shift their income away from capital gains, just like they moved into capital gains because the tax rate was lower. The primary benefit is preventing asset bubbles and bursts. A secondary benefit is making actual compensation more clear and transparent.

Incomed is income

Amen!

So

4) dump the “carried Interest” charade

5) tax capital gains (and anything else I may have missed) the same as any other income.

No reason that I can see to advantage those who happen to be able to afford a fancy accountant to move their income to special low tax classifications. Just pay it if you made it.

Giving them more cash to sit on seems unlikely to suddenly change that perspective.

Absolutely, wj.

Just pay it if you made it.

Gross or net? The ability to legislate away “net” income, and any meaningful tax liability, defies description (cf define income, variant).

Gross. At least for individuals.

Trying to figure out what individual expenses should be deductible, when it comes to generating income, seems like an incredible can of worms.

Tax all corporate income that is passed through in the year in which it was realized to shareholders or employees and thus subject to taxation on the earner.

Capital gains recognizes–the sale of a small, closely held business being the best example–the risk of tying up large amounts of time and money for a long term pay off. You get to sell your capital asset one time and one time only. The reason why purchasing an ongoing business or a capital asset that can appreciate is attractive is for capital gains tax treatment.

It seems to me a lot of the angst and anger about capital gains treatment is associated with a general ambivalence if not antagonism to the uber wealthy–a very fluid class when tax policy is under discussion. A lot of the capital gains preferential treatment that produces this angst is eliminated with a three year holding period. Want a 5 year holding period? Fine, make that a lower cap gains rate. It won’t get used much except in the one-time sale of a business. “One time” meaning the owner can only sell what he/she has one time. The subsequent purchaser can also sell, but that is a “one time” deal for that person/entity.

Some here also question whether reduced taxes will allow for more investment or, similarly, whether the wealthy invest and create more jobs. Given the millions of people and companies in the US, there will be a full range of activity, but generally, it is true the that majority of investment capital comes from wealthy people–it sure doesn’t come from the middle class or the poor. It is also at least arguable that if businesses pay less in tax, they will have more money to expand. Cynics who think owners just pull out every spare dime and let the business go to hell are letting ideology trump reality. With respect, how many here know enough business owners to know how they think, operate and manage their businesses?

Put differently, any business that expands either borrows money–which the owner is on the hook for–or uses current income to pay the cost of expansion. When I had my own shop, I paid expansion costs out of current earnings and reduced my tax liability by reducing my income.

Another reason for lowering corporate taxes is to see *IF* doing so dis-incentivizes large companies from going overseas. I’d like to think it would, but until we try it we don’t know. Everyone has their pet theories, but until practice meets theory, we are all just guessing.

I wouldn’t have a problem with someone who owns a business getting some kind of capital gains treatment. But someone who merely owns publicly traded shares in a company? Since that isn’t really tying up their capital in any meaningful sense, it wouldn’t seem justified.

Capital gains recognizes–the sale of a small, closely held business being the best example–the risk of tying up large amounts of time and money for a long term pay off.

Personally, I’m fine with retaining preferential treatment for capital gains realized by owner/operators. Especially if it’s their money.

That said, the capitalization of the NYSE as of June 2017 was $21.3 trillion. That’s more than the US GDP. That ain’t mom and pops.

Capital investors risk their capital. People who work for a living get their asses out of bed and show up every day.

You tell me why one deserves preferential treatment over another.

And it ain’t like people who work for a living exist in some kind of risk-free paradise.

IMO the way this whole discussion is framed is sideways. What people who work for a living bring to the table is not just hours on a clock, it’s knowledge, experience, personal responsibility, work ethic, along with a wide range of other qualities that are specific to whatever it is that they do.

Those things are capital. They are tangible assets that an enterprise can employ to create value. They should be thought of as capital, and capital that is the possession of the human beings who do the work.

Money is a fungible commodity. Anybody’s money is as good as anybody else’s.

Humans, and what they are able to do, is not a fungible commodity. It should not be treated as such.

With respect, how many here know enough business owners to know how they think, operate and manage their businesses?

Personally, I know a very generous handful, at a wide variety of points on the money scale, including folks who have built and sold businesses for nine figures.

At a more modest level, my mother and step-father owned and operated a small local business – literally, a mom and pop – for a number of years. Sadly, not a nine-figure operation.

My wife has personally been a small business, and has participated as a principal in a small-ish marketing consultancy operating as an LLC. In the latter case, her work was discussed favorably on the front page of the WSJ, above the fold.

Hope that gives me sufficient cred to have an opinion.

McKinney makes some good points.

Regarding cash hoard repatriation, here’s a skeptical note, from a business site. The writer is liberally biased from my experience reading him, but it’s an opinion piece not a news item.

https://www.marketwatch.com/story/trump-ryan-tax-plan-will-encourage-more-corporate-offshore-tax-avoidance-2017-10-24

It seems to me that in order for repatriation to work over time for all countries, there will need to be international accords on the matter, because you can bet Apple et al is already lobbying Ireland et al to get ready to further lower their tax treatment of corporate earnings to further undercut whatever rate the U.S. decides on.

Accords won’t happen under the current American regime, because discord among tax regimes leaves room for the blackmail of arbitrage.

The ultimate corporate tax rate on all corporate earnings Ryan/Koch have in mind is zero.

When Steve Forbes ran for President all those years ago, he promised draconian tax cuts across the board and then added ” … and then we’ll cut them again and again from there.”

Galt requires many gulches in which to hide his women and horses, like the Comanche.

Witness Amazon’s “competition” among cities for HQ2.

Cynics who think owners just pull out every spare dime and let the business go to hell are letting ideology trump reality.

There’s a lot of space between 1 – *simply holding onto piles of cash rather than making major investments and creating lots of jobs* and 2 – *pulling out every spare dime and letting the business go to hell.* And there’s plenty of evidence that option 1 is rather popular.

Corporate profits have generally been up for some time. Here’s where much of them have gone:

https://fred.stlouisfed.org/series/EXCSRESNS

An interesting detail has struck me. Republicans in Congress spent almost 8 years talking about how they wanted to repeal Obamacare and replace it with their wonderful alternative. But when they were finally in a position to do so, it emerged that they had not, in that whole time, bothered to actually figure out what their wonderful alternative looked like.

At the moment, after 8 years of dreaming of being able to slash taxes, the Republicans in Congress are rushing around trying to put together a tax bill on a rush basis. Because, in that whole time, they didn’t bother to work out the details of what their beloved tax cut would actually look like.

The consistent failure to spend any time and effort actually preparing to do things that they kept saying that they wanted to do is impressive.

The consistent failure to spend any time and effort actually preparing to do things that they kept saying that they wanted to do is impressive.

They are a rump opposition party that finds themselves in power due to accidents of history and assorted isms.

When it comes to actual policy, republicans are like Howard Roark in The Fountainhead. Even one little old balcony included in the design as a compromise is reason to blow up the entire edifice.

Or maybe it’s like the new high end sex robot technology; “she’s” still only 91% compliant with their exquisitely imagined tax kinks. How can we roofie this appliance and achieve 100% total domination?

Maybe like driverless cars: If our car is driverless, does that mean we aren’t held liable when it runs a momless baby stroller over, because otherwise we are going to have to flee from the scene on foot.

Also, it’s tough to include all of those small print yeah buts on a postcard, along with the pledges they signed with Norquist to never, period.

Why just three cuts? Why not a thousand?

http://www.motherjones.com/kevin-drum/2017/11/trump-granchildren-apparently-tapped-to-name-tax-bill/

Go bigly.

Which completely ignores the number of companies already sitting on huge piles of cash.

One of the reasons cash holders are holding onto their cash:

Regime Uncertainty

The consistent failure to spend any time and effort actually preparing to do things that they kept saying that they wanted to do is impressive.

they’re the reactionary, anti-expertise party. any other results would be out of character.

I’d like to think it would, but until we try it we don’t know.

But we do know. Effective corporate tax rates are not at all out of line with other OECD countries.

So why park all that cash overseas? Looks more like simple tax postponement to me.

Most investment is sourced from retained earnings. Taxing rich people to death will not lead to a dearth of sources of investment.

As the data provided by HSH shows, we have a huge overhang of excess banking reserves. We should all be getting cold calls begging us to borrow (at historically low rates, too!).

All this points to a lack of demand.

from Charles WT’s link:

“The chairman of China’s sovereign wealth fund said in late 2008 that China had no plans for further investments in Western financial institutions. “Right now we do not have the courage to invest in financial institutions because we do not know what problems they may have.” Mr. Lou said that the sheer pace of new initiatives and new rules issued by Western regulatory agencies was disconcerting and made it even harder for him to choose worthwhile investments. “If it is changing every week, how can you expect me to have confidence?” he asked.”

I can understand why the Chinese elite aren’t too keen on elections, especially after the near total collapse of the free market in 2008, when things appeared so stable.

How does he feel about the disappearance of the kid who stood in front of the tank in Tiananmen Square?

The tank stood for regime and investment stability.

I don’t know what to conclude about American and other foreign companies’ eagerness to invest in China, but they suffer heart attacks when some American city mandates a dollar an hour pay raise for part time workers.

Actually, that’s not true. I do know what to conclude.

Also, from the link:

“During the Great Depression, private investment had fallen significantly. Gross private investment plunged from almost 16 percent of GDP in 1929 to less than 2 percent in 1932; recovered to 13 percent in 1937 before falling again in the recession of 1938; and as late as 1941 stood at only 14 percent. During the war years, private investment ratios ranged from 3 to 6 percent. From 1946 through 1950 they ranged from 14 to 19 percent and averaged 16 percent.”

Roosevelt and his regulatory state weren’t elected until 1932, after three years of investment collapse under Hoover. Then it recovered under Roosevelt’s regulatory state, until the next recession, which have occurred periodically regardless of what ideology is in power.

Lots of farmers and small businessmen, mostly those under 5’2″, voted for Roosevelt in one of the largest landslides of all time.

Fascinating electoral map. The rural disenfranchised, those formerly blue guys, now red.

https://en.wikipedia.org/wiki/United_States_presidential_election,_1932

And, sure, war crimps, but mostly redirects investment. Wonder of wonders.

And the end of war revives investment.

Higgs proves very little ideological causation in any of this except that chickens get nervous and sit on it during storms.

Private investment capital expects the rest of society to accept massive change and instability in the latter’s individual lives and in their expectations about the future regarding all aspects of life at the hands of technology and in wage growth and the terms of retirement, but when the tables turn, mostly for good reason, investment capital turns into a bunch of neurotic snowflakes who can’t handle any change whatsoever.

One of the reasons cash holders are holding onto their cash:

Regime Uncertainty

hahahahah….really? Ummm, no.

One of two things will get folks to radically alter their cash preferences (1.) another tulip mania (the preference of Republicans, wingnuts, gold-bugs and assorted libertarians); or (2)government spending – i.e., government buying stuff (preferred by sensible folks).

Pick ’em!

One of the reasons cash holders are holding onto their cash:

Regime Uncertainty

The opposite is actually the case, we live in a era that far surpasses the last Golden Age in a) guarantees against high inflation (Central Banks can’t hit 2% for their lives, if you believe they want to), and b) a near impossibility of serious confiscatory or redistributionist politics arising.

And what’s worst is that the rentiers and technocrats have fully triumphed, as Veblen and proponents of managerial capitalism predicted they would, so we no longer even have the creative destruction of Schumpeter’s buccaneers and entrepreneurs. Venture capital is allocated for small scale experimentation, and the successful enterprises are bought by the monopolies before the founders get too ambitious.

Even gov’t spending, no matter how large, won’t change a rentier mentality without inflation. Scott Sumner, bless his black heart, is right that the central bank can always protect capital and rentiers from money deflation.

The point isn’t the spending, it’s the taxes. This is what liberals and moderates don’t get.

You have to create a regime of “Use it or Lose it,” and it has to be fierce and brutal and immediate. You have to make savings and rents disappear.

Capital speaks. What does it say?

Shut your workers’ First Amendment mouths and stuff them with pizza and hope they become fat and happy consumers:

https://finance.yahoo.com/video/papa-johns-slams-nfl-leadership-190600646.html

McManus’ 5:26pm seems like plain English to me.

As does your 4:05, Count.

Truly a remarkable thread. 😉

Private investment capital expects the rest of society to accept massive change and instability in the latter’s individual lives and in their expectations about the future regarding all aspects of life at the hands of technology and in wage growth and the terms of retirement, but when the tables turn, mostly for good reason, investment capital turns into a bunch of neurotic snowflakes who can’t handle any change whatsoever.

And what’s worst is that the rentiers and technocrats have fully triumphed

and there you have it.

thank you gentlemen.

Here is a good summary of the tax plan, with full details later today:

https://www.wsj.com/articles/republicans-stick-with-big-corporate-tax-cuts-in-house-bill-1509629510

Yeah, this whole thing has me ready to get out my pitchfork.

(At least it would if I had a pitchfork. I’ll have to settle for a weed whacker, but it’s electric, so all mayhem will have to occur within reach of my extension cord. I’ve been inside the system for too long.)

WSJ also live blogging the tax bill (which I think still has not been released in full):

https://www.wsj.com/livecoverage/tax-bill-2017

At least it would if I had a pitchfork

I have one you can borrow.

Bill is out:

https://waysandmeansforms.house.gov/uploadedfiles/bill_text.pdf

Section by section summary:

https://waysandmeansforms.house.gov/uploadedfiles/tax_cuts_and_jobs_act_section_by_section.pdf

This fairly short opinion piece sounds about right to me:

https://www.usnews.com/opinion/thomas-jefferson-street/articles/2017-11-02/the-republican-tax-cut-bill-doesnt-solve-any-real-problems

While a “pitchfork” is the traditional instrument to use, really it’s designed for *lifting* relatively lightweight stuff like hay, so the tines aren’t that solid.

I suggest using a GARDEN FORK, which is much better for the heavy duty stabbery.

or perhaps a Garden Weasel, if you just want to quickly make a lot of holes in whatever is near you.

if the pitchfork doesn’t do it, i have a mattock.

one hole, but a very large one.

i’d say torches, too, but apparently tiki torches are all sold out at home depot.

less sarcastically:

doubling the standard deduction is going to be nice for lots of folks who don’t itemize currently. which is a lot of people.

very wealthy folks get a great big cookie in the form of the maximum rate starting at $1M and (especially) getting rid of inheritance tax.

mortgage deduction gets capped at half a million, which will effect folks in parts of NY, MA, and CA, and people who want really big houses.

people who currently write off state and local taxes get to pound sand.

and, we add $1.5 trillion to the national debt.

it’s not a total horror show, and it’s not particularly great. some really wealthy families with elderly relatives are gonna be really really really happy, and folks who typically just fill out a vanilla 1040 are mostly gonna be kind of happy. mostly.

it’s kind of meh.

and addressing how to actually shore up revenue is…. in the wind somewhere. it’s the cheney doctrine, “reagan proved that deficits don’t matter”.

so, not so meh, after all. mirabile dictu, (R)’s are totally full of crap when they talk about fiscal responsibility. who woulda thunk it.

it sure as hell is not anything like a comprehensive overhaul of the tax regime.

i guess the (R)’s need a win, and i guess this is what they came up with.

meh.

Looking at the additional details made available today, my federal taxes under the current plan would remain roughly the same, but I wouldn’t have to itemize. The additional “family tax credits” more or less offset the elimination of personal exemptions. The change in brackets is basically a wash. So I’ll take that as a minor win, for me, based on that very narrow and short-term assessment.

What it means for the nation as a whole in the longer term is another question.

At least it’s a sure-fire big win for anyone inheriting a butt-load of money!!! Yippee!!!

it’s not a total horror show,

Actually, I think it is.

I note that medical expenses are no longer deductible, among other things.

On the whole, this is a giant giveaway to wealthy people . That’s all. The rest is optics and talking points.

“We didn’t cut the top rate,” etc.

These people are scum. Every one. And Paul Ryan is the worst.

I’ve been thinking about the increase in the standard deduction versus the caping of the mortgage-interest (MI) and property-tax (PT) deductions, as well as the elimination of the deduction for state and local taxes.

I think it’s fine to increase the standard deduction, but acting like keeping the MI and PT deductions is some sort of compromise, after you’ve capped them – thereby making them irrelevant for the vast majority of people – when you consider the increased standard deduction, is …well, a very Republican thing to do.

They virtually got rid of those deductions without technically getting rid of them. They’re still in the code, but they’re all but useless.

If taxing the portion of your income that you spend on state and local taxes is not “double taxation”, then what the hell is?

I have not had time to examine the details of the GOP tax “reform”. I may not bother: if Lying Liar Paul Ryan is fer it, and Yertl the SCOTUS Thief is fer it, I’m agin it. Tribal thinking? Sure. One tribe is composed of liars, charlatans, and stupid people, and I belong to the other one. I will let “moderates” and “independents” do the close analysis, if they have enough time on their hands.

–TP

if Lying Liar Paul Ryan is fer it, and Yertl the SCOTUS Thief is fer it, I’m agin it. Tribal thinking? Sure. One tribe is composed of liars, charlatans, and stupid people, and I belong to the other one.

Yes. Thanks.

If taxing the portion of your income that you spend on state and local taxes is not “double taxation”, then what the hell is?

don’t you see? this will cause all those high-tax blue state residents to realize just how much their states tax them (since they won’t be able to deduct it any longer). now, they’ll rise up and elect Republicans who will lower their taxes! and GOP-Brand Freedom™ will spread throughout the land!

Double taxation is only wrong when it comes to corporations and shareholders. Like, duh…

You’re paying two different governments for two different sets of services. Not really double tax. Or put another way, it’s one tax just at a higher rate.

But it is a big FU to blue states and if they are going to get rid of it they should phase it in over 10 years

The thing that’s kind of weird about the FU to the blue states is that it affects people whose itemized deductions would exceed the new standard deduction. (I’m assuming we’re mostly talking about married people here.)

I’m no high roller, but I am above the average, certainly when it comes to property tax and mortgage interest, for my blue state. My household itemized deductions this year will be a bit less than the proposed standard deduction.

The people this is really going to affect are pretty well off, given the caps on property taxes and mortgage interest that can be deducted and the elimination of the deduction for state income taxes. Think of someone with a $900k house paying $20k/yr in property taxes, $22k/yr in mortgage interest on a $600k mortgage, and $7k/yr in state income taxes. I’m not sure how that sounds to people, but that’s not “rich” by the standards of places like Morris County, NJ.

It’s not so much that these are people who would vote Republican in large numbers in a state like NJ and are now going to switch parties. But they might not have been terribly prone to put their resources behind Democrats, either. Like I wrote, they may not be “rich” by local standards, but they do have resources.

I guess I’m not sure how smart (or how stupid – like really, really stupid or just really stupid) this particular FU is in the long run.

any dumbbell can “cut taxes” by adding $1,5 trillion to the national debt.

when (D)’s incur debt, they do so by taking in revenue and spending it on stuff.

when (R)’s incur debt, they do so by reducing revenue and assuming that the free market fairy will take the money that isn’t paid in taxes and turn it into Economic Growth. which will somehow result in increased federal revenue.

one approach looks, to me, like investment. one looks, to me, like magical thinking.

can you guess which is which?

i’m sure there are contexts in which cutting taxes and incurring debt is an effective way to spur growth.

given the amount of plain old leafy green cash that is sitting around in big corp and bankster accounts, i find it hard to believe that this is one of them.

growth is currently slow because there isn’t enough money available for investment?

pull the other one, it’s got bells on.

I note that medical expenses are no longer deductible, among other things.

the (R) health care plan. actually, there are two.

1. don’t get sick

2. die fast

one approach looks, to me, like investment. one looks, to me, like magical thinking.

Just as a wild guess, I’d say that the magical thinking was being practiced by those who most strongly support banning books which include magic from school (and even public) libraries. Maybe the don’t want people to become too familiar with magic, lest they see the flaws in how it’s being practiced…?

What I see:

For people like me, not me because I am not helped by thus partucularly, it is what was promised.

Simple tax preparation with lower rates.

I lived in MA in a house for 25 years or so and never had a mortgage near 500k. I’m sure lots of upper middle class folks won’t like that cap, in a few states.

Mostly though I think it is a stretch to deny that this is a tax cut that is good for a large majority of those people who are considered Trump voters.

And it addresses some corporate tax issues that needed to be addressed.

And rich people’s families get to keep their money when someone dies. We all should hate that for some reason that is completely beyond me.

The justification is that it will keep the economy growing at just over 3%, which makes up the 1.5 trillion. That’s not that big a stretch.

Pretty well constructed, a few exceptions to avoid really hurting the people who it effected negatively, not bad for Washington.

And rich people’s families get to keep their money when someone dies. We all should hate that for some reason that is completely beyond me.

Rich people get to receive the dead person’s money, not “keep.” I think given the corrosive effect of billionaires on our politics over the past few years – the Kochs, Mercers, DeVos, Thiels, Soros (though wildly overstated) – is good reason to be wary of concentration of wealth and to do something moderate about it.

the tax cut for “typical” family the GOP and Ryan keep citing is $1142 (for now). The increase in the estate tax exemption is…$5.6 million per person (so twice that with a spouse), saving $2.24 million in taxes for the estate of the dead at the 40% rate.

They “typical” family would thus need to receive their $1,142 in tax breaks per year for 1961 years before they saved as much in taxes as the estate tax saves multimillionaire estates. And that tax break will go down in 5 years while the estate tax goes away completely….

Ugh,

That logic is simply flawed. Yes, really?, tax cuts for people making 50k are much lower?

But that $1,142 means a lot to them, an argument that is made all the time when discussing potentially charging those people for something. In fact it was the argument for not doing across the board tax increases.

And, heirs get to keep or receive the family money is word games. Either they get it or it is confiscated simply because someone died. The closest thing to theft in our tax system.

More on overseas cash repatriation:

https://finance.yahoo.com/news/why-tax-plan-might-not-040708718.html

The closest thing to theft in our tax system.

In general, the US derives revenue by taxing the transfer of money from one party to another.

Income tax, unearned income taxes of all kinds, gift tax, windfalls like winning at the track or the lottery.

Inheritance tax is just another one of those. You die, you leave money to your kids, it’s income to them, they get taxed on it. It’s not like there aren’t a gazillion ways to shelter that if you want to, and it’s not like there isn’t an army of accountants and financial planners who will help you set that up if you happen to be in the position of being subject to inheritance tax in the first place.

Also in general, the US follows a progressive model for assessing taxes. Adam Smith makes the best case I am aware of for this, IMO it’s a sensible regime.

The inheritance tax (gift tax, too, I think) currently kicks in at about $5.5M per person. About $11M for a couple.

Should you leave an estate in excess of that to your heirs, the amount above that limit will be taxed at 40%.

So, first $5.5M tax free, everything beyond that at 40%. Which is within a percentage point of the top income tax rate.

So, WTF is anybody bitching about.

This is a hand-out to wealthy people. I doubt it will make much difference to the overall revenue stream either way, it’s just the (R)’s throwing a bone to the wealthy.

Simple tax preparation with lower rates.

how is it simpler?

Once upon time, the rich took it with them when they died: kings and chieftains were buried with their gold and jewels and weapons and so on.

If the Koch brothers convert their $50B apiece into cash and, when the time comes, take it into the grave with them, I would not tax it.

–TP

Get rid of the inheritance tax.

The year the money is received by the beneficiaries, it must be declared as income, which is what it is, and taxed as income tax according to whatever marginal rate applies.

Make some amount tax free, as now. Also permit the wealth to be distributed in increments from over some number of years.

Then conservatives go can go back to calling ALL taxes theft.

Or they can shut the f*ck up about the sacred nature of work, which they don’t believe anyhoo given the poor remuneration they bestow on workers, because work is one thing most heirs do not do for the the inheritance gifts they receive.

Another feature of the GOP bill is getting rid of the deductions for adopting children.

I guess that means, given conservative bullshit theories regarding tax incentives and disincentives, that there will be fewer adopted heirs in the future.

Maybe orphans can be considered capital equipment and thus slip through.

More orphans and more abortions.

The sanctity of life, another GOP shibboleth.

“I doubt it will make much difference to the overall revenue stream either way, it’s just the (R)’s throwing a bone to the wealthy.”

I don’t disagree with this, at all. The top tax bracket at 1M is kind of the opposite, it wont make much difference to the revenue stream but is a way to throw a bone to the folks who don’t want a tax cut for the rich.

how is it simpler

I have itemized every year for a long time, the standard deduction increase means I probably won’t. That’s a lot simpler for what I figure is going to be a lot of people. Picking winners and losers, HR Block will certainly be against this bill.

we’ve itemized forever, because we’ve always had an accountant handle our taxes (multiple businesses and lots of donations, etc. – easier to let him sort everything out). this is going to be the first year we’re going to try to do it on our own.

but, if you’re set on paying the least amount in taxes, don’t you have to itemize first, figure out what that works out to, and then compare it to what the standard deduction would get you ?

is a way to throw a bone to the folks who don’t want a tax cut for the rich.

Everybody making more than about $420K and less than $1M gets a tax cut.

Some folks who call people with earned income in that range “rich”.

Everything is relative.

In general I agree that doubling the itemized deduction is going to be somewhere between nice and really nice for a wide swath of working people.

It may or may not result in an actual tax savings, that depends on what folks have been writing off.

It’ll just be simpler. Which is not a bad thing, on its own terms. And maybe save them some money, although in at least some cases they’ll have to run the numbers anyway to figure that out.

And rich people’s families get to keep their money when someone dies. We all should hate that for some reason that is completely beyond me.

Well, revenue has to come from somewhere. Every penny that doesn’t come out of Ivanka Trump’s inheritance comes from you and me.

Plus, I’d rather not have a permanent hereditary aristocracy.

Plus, much of the money -capital gains – is never taxed.

Plus, rich people’s kids enjoy enormous untaxed advantages growing up and beginning their careers. How much do they want?

On the one hand we have “tax cuts encourage productive work.” But the same people making that argument are glad to have a class of worthless trust funders, as long as the TF’ers can be counted on for political support.

Plus rich people – the super rich who are the only ones affected – have an outsized influence on American politics. That’s not a good idea, since it will only increase their wealth and power.

Finally, it is, as Daniel Davies as famously pointed out, a strong clue that a proposal is unwise if it sold using a lot of lies. That’s what happens here with all the crocodile tears over family farms and businesses.

You know what I’d like to see? An inheritance tax like what the Count suggests. 50% on all inheritances with say, a $1M exemption. Want to leave a friend or someone who worked for you, or a good teacher, a few hundred grand. Fine. No tax. But leave your kid $100M and $49.5M goes to Uncle Sam.

On the one hand we have “tax cuts encourage productive work.”

Getting freaking paid encourages productive work.

The justification is that it will keep the economy growing at just over 3%, which makes up the 1.5 trillion. That’s not that big a stretch.

Are you saying the $1.5T in lost revenue is equal to the resultant economic growth, or are you saying the resultant economic growth will result in an offsetting increase in revenue of $1.5T, making the tax cuts “pay for themselves”?

(Certainly, that $1.5T dollar loss to the federal government will be in someone else’s hands, some of it with state and local governments, most of it somewhere in the private section – not necessarily in the United States – to be saved, spent, or invested.)

IIRC, the federal government taxes estates (what remains legally of the deceased), but the states tax inheritances (what living heirs receive).

My suggestion would be for states hit hard by the federal deductions eliminated or capped to take advantage of the larger inheritances resulting from untaxed estates.

section = sector in my 11:36.

it will keep the economy growing at just over 3%

it’s been growing at 3.2%, on average, since 1947 – without the TrumpRyan tax cuts.

The justification is that it will keep the economy growing at just over 3%, which makes up the 1.5 trillion. That’s not that big a stretch.

The real question is whether the CBO will score it that way. The Republicans are doing this under reconciliation rules to avoid the Senate filibuster, and those rules require the CBO to score the final bill that the Senate votes on.

Duncan Black on the estate tax.

Russell,

Getting freaking paid encourages productive work.

I agree with you 100% – not surprising.

I was citing arguments in support of tax cuts on high earners, not endorsing them. I don’t think cutting Dustin Pedroia’s taxes is going to get him to play 200 games instead of 162.

To the extent they do encourage work, I’d say the effect is greater at low to middle wage levels. I suspect a plumber or electrician is going to be more willing to put in some overtime if the after-tax wage goes up than the CEO is to put in a weekend of of work.

For high-income workers who have a fair amount of control of how much they work the increased after-tax wage may well have the effect of reducing hours worked in favor of taking more leisure.

Google “labor-leisure effect” for an endless supply of explanations.

Pedroia would play 365 games a year if he could.

And raising his top marginal tax rate to 90% wouldn’t cause him to give up the game and become a plumber.

The plumber, if he had the talent, would be happy to replace Pedroia at second base.

Pedroia would play 365 games a year if he could.

Because he’s gritty, and plays the game the right way, and isn’t in it for the money.

Yeah. I live in Boston and know all that.

The justification is that it will keep the economy growing at just over 3%, which makes up the 1.5 trillion. That’s not that big a stretch.

I don’t think that’s a good argument. First of all, you would have to show that the tax cut will in fact improve economic growth. That’s far from known. Very far.

Second, you have to show how much it will help growth. Let’s say the economy grows at 3% from now on. You can’t say it was all due to the tax cut. Mostly it isn’t. So no taking credit for everything anyone does.

Finally, claims of self-financing tax cuts have always been nonsense, and proven to be so by actual analysis. So history is not on your side.

I think they want to get rid of the estate tax because wealth is insufficiently concentrated nowadays. That seems to be causing a lot of problems.

I was citing arguments in support of tax cuts on high earners, not endorsing them

No worries Bernie, my comment was not really in response to the substance of what you were saying.

It was just kind of a general comment.

I agree with your points here.

Well byomtov, factual analysis that I have reviewed simply doesnt prove that, and if we achieve steady state greater than 3% I’m fine with the fact that lots of other factors come into play also. I am also sure that if we don’t lots of other factors will have come into play.

On my point about the estate tax and a family earning the median income’s tax cut of $1142. One of the talking points from the GOP is in the form of “charge and response”:

Charge: “Repealing the [Estate] Tax is just a massive giveaway for the wealthiest Americans.”

Response “Not so. The [Estate] Tax impacts small businesses and farms throughout the nation owned by people who have worked their entire life to build a successful company and create jobs.”

If you’re small business is worth so much that you can sell it outright for $5.6 million (or double that if you’re married) at your death you are, beyond a doubt, wealthy.

By extension they are saying “won’t anyone think of the poor small business owner, we need to save him this tax of $2.24 million when he dies”, and also saying “$1,142 is a lot of money!”

They are fucking liars.

Moreover, the 10 year revenue effect of increasing the estate tax exemption and then repealing it is a loss of $171 billion. How much bigger would that very important $1,142 be if we kept the estate tax as is and used the $171 billion to provide additional cuts to those getting the $1,142 (which again, will be smaller 5 years hence)?

US GDP was $18.57T in 2016, over 10 years that’s $185.70T (assuming no growth or decline, and the former is much more likely). GOP’s tax cut is $1.5T over those same 10 years, or 0.8% of the total GDP over those 10 years.

And yet we’re to believe that that amount of tax cuts is going to result in an extra, what, 0.5 to 1% GDP growth *each year* than without the tax cut?

Seems doubtful.

Its about 171 dollars a year averaged across 100m households.

It is expected that that amount of tax cuts targeted at particular parts of the GDP, corporate and middle class, will support .05% additional growth.

Very reasonable.

Correct me if I am wrong, but Marty is essentially arguing that the tax cut will have a multiplier effect on GDP of about 1.6 over the next ten years.

This is not reasonable.

Otherwise, what byomtov and Ugh said.

Also, this.

Its about 171 dollars a year averaged across 100m households.

171 bucks a year, per household, is going to stimulate the economy by 3%?

That’s $3.29 a week. Per household, natch. But that’s not even a Big Mac.

Maybe I am misunderstanding your point.

The [Estate] Tax impacts small businesses and farms throughout the nation owned by people who have worked their entire life to build a successful company and create jobs.”

See. This is a lie. Period. it doesn’t impact them at all. If it did where are all the stories of people forced to sell, etc. I just wish that this was more widely known. That the GOP advances this claim at all ought to make all decent people shun it and its works.

Businesses worth the kind of money being talked about do not typically have a single owner. They are generally incorporated, or operate as partnerships, and have multiple owners. The estate tax, if there is one, is only on the decedent’s share, obviously.

Your neighborhood hardware store is just not worth enough to trigger an estate tax. Not near enough. And if it doesn’t have outside investors, it is likely owned by a married couple, with maybe their kids having a piece as well.

You might also check Section 6166 of the Internal Revenue Code which provides a very generous way to pay the tax, if there is any, over 14 years at a low interest rate.

So these people are just lying, and I refuse to take any claims they make seriously.

The 171 was the answer to how much more we could give everybody else if we didn’t do way with the estate tax. That’s all.

So these people are just lying, and I refuse to take any claims they make seriously.

If anyone caught the CNN debate between Bernie Sanders and Ted Cruz a couple weeks ago, the estate tax was a major topic. (The debate was specifically on tax reform.)

Cruz did his fake, folksy story-telling about family farms and such, after which Sanders cited, you know, actual data demonstrating that it was a bunch of horsesh1t.

It probably didn’t matter, though.

The 171 was the answer to how much more we could give everybody else if we didn’t do way with the estate tax. That’s all.

No, this one tax, by itself, isn’t going to make a huge difference, but there are lots of them and they all add up. So the question is over which ones should be at the top of the list for reform of some sort. The estate tax has been reduced already by exempting larger amounts. Because of that, eliminating will make less of a difference than it otherwise would without those reduction. Imagine that.

https://en.m.wikipedia.org/wiki/Estate_tax_in_the_United_States#/media/File%3AEstate_Tax_Returns_as_a_Percentage_of_Adult_Deaths%2C_1982_-_2010.gif

This table is probably more illustrative than the graph at the link in my last.

https://en.m.wikipedia.org/wiki/Estate_tax_in_the_United_States#Exemptions_and_tax_rates

“Maybe I’m misunderstanding your point.” *

His point is that at $3.99 per Big Mac, the average household could afford an extra Big Mac every 9 days. That’s 40.555 more Big Macs per year.

And THAT doesn’t include Fetuses Eat Free Fridays.

from Politico via Charles Pierce:

“The legislation includes language that would open up tax-advantaged college savings accounts known as 529s to what the legislation calls “unborn children” as designated beneficiaries. And a bill summary specifically defines that as “a child in utero. A child in utero means a member of the species homo sapiens, at any stage of development, who is carried in the womb.”

In-utero orthodontics would be the only medical expense that would retain its status as a deductible item, as a sop to the cousins of elegists in hillbilly country.

In order to “pay” for that feature of the bill, Grandma won’t make it to McDonald’s, as she can no longer deduct a cent for her medical expenses over the year, so she’s heading over to the Burger King’s new capital intensive franchise, The Hemlock Shack.

Fetuses conceived during immaculate conceptions, meaning any fetus that resulted from a night out with Mike Pence, would qualify for a double exemption, having pulled off being pre-born and born again simultaneously.

In-utero firing ranges could be expensed as a capital improvement.

*Dang it, Marty, respond faster, or slower, so you don’t step on the punchlines.

I’m having a hard time following some of the arithmetic here. Let’s see. The tax cut will ostensibly reduce revenue by $1.5T over ten years.

So for that to be made up by increased economic growth means that, assuming the federal government gets 18% of GDP in taxes (slightly generous here), the economy needs to be $8.33T larger over that period than without the cut. So $833B/year.

That’s about 4.5% of the $18.5T/yr we now have.

Did I make a mistake?

Your neighborhood hardware store is just not worth enough to trigger an estate tax.

Yep. If your neighbor through luck and pluck built up an estate of $10m or more, it most likely would have been accomplished via real estate investing/acquisition….an economic activity that is, for all intents and purposes, one that is (a.)highly artificial; (b.) riddled with an incredible array of special tax jiggeries, and (c.) driven by squatter ethics in many instances.*

Taxing the hell out of such a pile is a social necessity.

*buy your shy 5 acre plot on the outskirts to “enjoy the woods” and “a rural way of life”; occupy the place for 30 years while you commute to your job in town on roads funded by city taxpayers; vociferously oppose any and/or all reasonable growth management policies because “freedom”; retire, subdivide the property, cash out, and move to Florida. To make things worse, they pat themselves on the back for “creating wealth”. Jaysus ‘effing christ.

Even without the jiggery pokery bobbyp describes, the fact is that anyone who has attained a multimillion-dollar estate did so within the context of an ordered society, relying on infrastructure and institutions they did not create. But let’s keep concentrating more and more of the nation’s wealth in fewer and fewer hands. It’s certain to end well.

The 171 was the answer to how much more we could give everybody else if we didn’t do way with the estate tax. That’s all.

given the choice of forty-and-a-half big macs per year, or making the world safe for some rich guy’s kids to not have to pay 40% on inherited money in amounts greater than five-and-a-half million, i’ll take the big macs.

YMMV

The rich guy’s kid isn’t getting Big Macs, too, is he?

The 171 was the answer to how much more we could give everybody else if we didn’t do way with the estate tax. That’s all.

You know, if we swung all the paragons of wealth from lamp posts and distributed their wealth evenly, the amount per person would not be all that much.

But that’s not the point.

Almost any tax cut or spending increase which increases the budget deficit will generate some additional growth, provided that the total debt is not too scary. But the least effective deficit increase is tax cuts for the rich.

Is it a good idea currently to increase the deficit? No it isn’t. How much power over the US economy do you want to give to overseas bondholders, China in particular?

we’re already growing at 3%.

we’re already near full employment.

why do we need a larger deficit?

https://www.marketwatch.com/story/republican-tax-reform-is-simply-red-states-stealing-from-blue-states-2017-11-03

Hannah Lassette Ahlers

why do we need a larger deficit?

to pay for the tax cuts.