–by Sebastian

I've been trying to make sense of why in debates over economic stimulus, the cleave between tax cuts and stimulus funded by deficit spending attracts so much heat. They are effectively the same thing from a deficit point of view. They are largely the same thing from a stimulus point of view (the tax cuts act faster, which is better, but the spending can also help people who aren't working which is good). We really should do both if are convinced the stimulus is what we need.

But in reality we have Democrats advocating spending stimulus and Republicans advocating tax cut stimulus while each side vehemently opposes the perfectly defensible stimulus of the other. I couldn't make any sense of that.

But the problem is that stimulus is really about temporary measures. And so when Democrats advocate temporary spending stimulus, the fear is that they can't be trusted to cut it later. And that fear is fairly well grounded. I'm not aware of a long history of cutting programs in the Democratic Party. (Pretty much just the Defense budget when we thought the end of war was near after the Soviet Union fell. And I don't see many stimulus proposals in the Defense budget

)

When Republicans advocate temporary tax cut stimulus, the fear is that they can't be trusted to raise taxes later. And that fear is fairly well grounded. I'm not aware of a long history of raising taxes from the Republican Party. (Pretty much just Bush I, and he wasn't exactly praised for that).

So, no solution proposed. Just an observation.

a spending stimulus, at least like the one Obama got, is a fixed amount of money targeted to be spent in specific ways. how can that continue once the money runs out ?

I’m not aware of a long history of cutting programs in the Democratic Party.

http://en.wikipedia.org/wiki/Personal_Responsibility_and_Work_Opportunity_Act

I’m not aware of a long history of raising taxes from the Republican Party. (Pretty much just Bush I, and he wasn’t exactly praised for that).

http://www.google.com/search?hl=en&rlz=1C1CHMZ_enUS357US358&q=reagan+tax+increases

Sebastian — it is also a matter of targetting and efficacy. If you want a debate on a stimulus that is overwhelmingly composed of temporary FICA tax cuts, expansion of the Earned Income Tax Credit and a fully refundable expansion of the standard exemption, Democrats would quibble here and there but I bet you could find at least 75 Reps and 15 Senators to vote for that package. That package would be reasonably efficient at producing short term stimulus because it is broadly targeted at low and middle income people who are cash-constrained.

That was never the GOP proposal. They wanted to cut their hobbyhorses (AMT fix, estate tax extension, top marginal rates, capital gains rates) where the benefits go overwhelmingly to people who will pocket the cash. The bang for the buck absolutely sucks according to any macro-model.

I seem to remember the early 2009 stimulus being about 1/3 tax cuts and being supported by all the Senate Democrats and pretty much all the House Democrats, while being opposed by all but three Senate Republicans and all but one House Republican. So the Democrats have been pretty pragmatic about things. The problem is that the Republicans don’t support any kind of stimulus that doesn’t go to the rich, which isn’t very stimulative. Democrats have been and are willing to give tax cuts as a compromise when added to new spending; Republicans just can’t compromise.

Yeah, somehow I doubt that an estate tax cut would provide much stimulus.

But if some rich GOPer wants to die just to take advantage of a tax cut, far be it for me to stand in their way.

No, the real problem is the economic level to whom the stimulus is targeted. To be an effective stimulus, it needs to be turned into “demand”, and if you hand a millionaire a stimulus, it will be turned into “investment”.

There’s already plenty of investment dollars available, it’s the demand that’s missing.

No. They are not “effectively the same thing from a stimulus point of view.” Low-end tax cuts are helpful, lowering top marginal rates is not.

Extending unemployment benefits is even more helpful, and quick too, as are stimulus programs to help the states keep teachers and other workers employed.

Aid to the poor, especially food stamps, is very stimulative and exceptionally quick.

Aid to states to prevent layoffs in a market with near 10% unemployment is, likewise, immediate. Some don’t consider this “stimulative,” but not doing so is “anti-stimulative,” so it counteracts negative externalities that are certain to come when consumers no longer have income they expected to spend.

Tax cuts to lower income thresholds are not as fast, but still effective.

Republican arguments that large tax cuts for high earners isn’t in any way a serious stimulus proposal.

Republicans just can’t compromise.

“Read my lips, no new taxes!” Who got that stuck where the sun doesn’t shine by Bill Clinton 2 years later. So much for compromise.

It’s about who pays, and who gets.

The complicated and contradictory rhetoric over tax-and-spend, balanced budgets, big government vs. small government, etc. became much clearer to me once I realized that. Neither party, no major ideology in this country, is really specifically for big government or small government; they just disagree about who gets the money and who pays the money.

Don’t make the pledge if you can’t support it. Particularly ironic since he was saying in the full spiel that while his opponent might consider raising taxes if it was a necessity, he would never do that and resist a Congress that did.

One of the things that I admire about Obama has done a fairly good job of keeping his pledges.

If the Republicans can’t compromise without being thrown out of office, it sounds like they need to adjust their platform to be more in line with the policy preferences of the people in the USA.

Of course, George HW Bush faced a recession during the second half of his term. That, and the presence of a spoiler third party candidate screwed him. The consequences of breaking his primary domestic policy campaign promise had at most a marginal effect.

The consequences of breaking his primary domestic policy campaign promise had at most a marginal effect.

Some margins are bigger than others:

About one in four voters said Mr. Bush’s reversal of his 1988 “no new taxes” pledge was very important in making their choice for President this year. Of those, roughly two-thirds voted for Mr. Clinton.

It’s pretty well established that economic factors, such as GDP growth and unemployment, have a much larger effect on presidential reelection than success or failure at keeping campaign promises. The chart in this report shows that a traditional model, which does not take account of campaign promises, predicted within .1 percentage point the share of the two-party vote won by Bush in 1992.

People say all sorts of things; are you suggesting that voters upset by Bush raising taxes happily voted for Clinton? I think it’s more likely that the broken promise/tax hike is a post hoc rationalization.

Evan: You’re probably right.

are you suggesting that voters upset by Bush raising taxes happily voted for Clinton? I think it’s more likely that the broken promise/tax hike is a post hoc rationalization.

So, Republicans should compromise with Democrats and not complain when that gets jammed down their throats, because, hey, they were going to lose anyway.

The point is that both sides punish compromisers. There is no upside to finding a middle ground.

HW Bush didn’t lose his reelection campaign because he went back on a promise and/or compromised with the Democrats. He lost because of a shitty economy. That’s what that discussion was about; it’s irrelevant to the discussion about compromise.

And my point was that Democrats did compromise with Republicans. The Republicans’ response was to lie about the contents of the bill (i.e. deny that it cut taxes) and claim the bill made things worse, closing off the possibility of further compromise.

And I’m not sure what was jammed down your throat, but I’m awfully sorry about that; it sounds much more unpleasant than the outcome of a legislative battle not lining up perfectly with your policy preferences.

Republicans who compromise with Democrats get primaried by the Club for Growth, or the fundamentalists, or the Tea Party, or whatever.

Democrats who lose an election, leave the party, and campaign for the Republican get a Senate Chair seat. Wait, let’s try again,

Democrats who run against the party and the President, and compromise with Republicans even after the Republicans say they won’t vote for the bill no matter what, compromise with Republicans to undermine other Democrats making a stand against far-right judges, stall the health care bill for months and compromise with Republicans in return for nothing, get to keep all their perks and go on the Sunday talk shows. Wait, that’s not equivalent either.

Democrats who compromise with Republicans without getting anything in return, threaten fillibusters over farm aid for their home state, oppose a public option for health care, and oppose the EFCA get primaried and manage to win in a squeaker to probably lose against a Tea Partier. AT LAST! EQUIVALENCE! David Broder would be pleased!

The point is that both sides punish compromisers. There is no upside to finding a middle ground.

Yeah, boy, that Bill Clinton sure took a beating from his base over DADT, welfare reform and the war in Bosnia, huh? Oh, wait, I meant he handily won re-election.

It’s probably useful to point out that tax cuts for those in higher brackets are more likely to go to savings than consumption This increase in savings would put small downward pressure on interest rates which would be more than offset by the cost to the government of borrowing the money back. I question whether there is any stimulative effect at all for upper income tax cuts.

Spending increases which drive employment to middle income (teachers, first responders, etc.) and lower income (day laborers) households tend to get spent and wind up in income for those with whom the money is spent (which is then spent by those, etc – aka the multiplier effect) which ultimately results in higher tax revenue. This tax revenue makes the cost actually less than the nominal cost.

Finally, consumer demand and a productive work force (which in the sort-run is affected by good transportation and communication infrastructure and in the longer run good education and work habits) will attract investment from abroad. Absent consumer demand and a productive work force, the tax cuts to wealthier people will result in those marginal funds getting invested abroad in markets which have those qualities.

I think, Sebastion, you should step back, do a bit more research, and come back and try this post again.

You’ve made several false assumptions in it, and totally neglected some basic facts.

Not all spending is the same. Not all tax cuts are the same. And the bill that passed was roughly a third cut taxes. (Not to mention your point about stimulus spending was nonsensical. It was a lump sum allocated for a specific time period. How can it not end?)

What you need to ask yourself is what can honest, reality-based people conclude are EFFECTIVE stimulus?

Unfortunately, “honest, reality-based people” would conclude that while there were effective and efficient tax cuts, none of them were the sorts being proposed by the GOP.

The research on this isn’t hidden. There’s nice CBO reports scoring various proposals, research on demand-based recessions — the stimulus, unlike say TARP, was so straightforwardly out of a basic economics textbook that I’m really surprised you wrote such a bad, clueless post about it.

McKTx,

Clinton didn’t attack Bush I for raising taxes, he attacked him for making grand promises he couldn’t keep. The issue was that Bush I had won election, in part, by making a very specific pledge which he then utterly ignored once in office. Do you really think Clinton would have gone after him on taxes absent that initial campaign promise? It wasn’t the taxes, it was the perfidy.

I’m really failing to see how the Personal Responsibility and Work Opportunity Act counts as Democrats cutting spending. It was a Republican Contract with America item that Democrats had to be dragged kicking and screaming to.

“Unfortunately, “honest, reality-based people” would conclude that while there were effective and efficient tax cuts, none of them were the sorts being proposed by the GOP.”

That isn’t the case. The FICA employment tax holiday/cut is considered one of the most stimulative tax cuts available, and was proposed by the I-generally-despise-him-but-he-certainly-counts-as-a-Republican Newt Gingrich as far back as December 2008. It was proposed in Congress by Rep. Louie Gohmert (R-Tex).

Seb, do Gohmert and/or Gingrich propose to make the SS Trust Fund whole (out of general revenue) for the “FICA holiday”? If they don’t, it’s just another ploy in the never-ending GOP effort to undo the New Deal.

–TP

That isn’t the case. The FICA employment tax holiday/cut is considered one of the most stimulative tax cuts available, and was proposed by the I-generally-despise-him-but-he-certainly-counts-as-a-Republican Newt Gingrich as far back as December 2008. It was proposed in Congress by Rep. Louie Gohmert (R-Tex).

And yet never had any serious Republican votes.

You can’t convienently ignore the fact that what the GOP caucus in BOTH the House and the Senate were offering were upper-end tax cuts and corporate tax cuts, Seb — ONLY. You don’t get to count “Oh hey, one Republican offered something and then his entire caucus ignored him”.

I realize it doesn’t fit into the Broderistic view that, of course, everyone ie equally wrong and True Enlightenment exists in the middle.

In the real world, the Senate GOP offered a [url=http://wonkroom.thinkprogress.org/2009/02/02/senate-conservatives-plan/]stimulus plan[/url] (DeMint’s) which mentioned NOTHING about FICA rates, but did eliminate the AMT, lower the top marginal rates, and eliminate deductions for things like higher education. (Also, it was permanent).

Of course, DeMint only offered this after Democrats finally started snapping at Republicans to either put up or shut up. And then got laughed out of the room.

As I said: There are stimulative tax cuts that would have worked in this recession. They were NEVER seriously proposed by the GOP, or else they would have been in the 1/3 of the stimulus that was, in fact, nothing but tax cuts and that was placed there entirely to try to bribe a handful of GOP members to vote for the bloody thing. (They didn’t).

Anyone who was even vaguely following the entire debate would have realized that the GOP wasn’t serious about a FICA bill, it never got any play, and in fact their entire legislative weight was aimed at cuts to capital gains, the AMT, and the upper marginal rates. THAT was what they were voting for, pushing, requiring in order to even “consider” voting for the bill.

I’m pretty sure if you bothered to look, this very blog had a number of posts about it. Claiming otherwise is to fall for what amounts to, at best, highly transparant propaganda or just a rewrite of history that happened less than a year ago.

As I said: You’re smarter then this. So why do you push it?

“It was proposed in Congress by Louie Gohmert (R-Tex.)”

Louie Gohmert has proposed a lot of things.

Never have so many delightful things been proposed since Heinrich Himmler quit his day job as a chicken farmer to dedicate himself to government service.

Good ideas aren’t propaganda. They are good ideas. They are good ideas even when proposed by Republicans. You can be hyper-partisan about rejecting good ideas that come from Republicans if you want. I don’t see why I have to buy into that.

You haven’t once suggested it was a bad idea.

You haven’t once suggested that the good idea offered by Republicans, good faith or not, was adopted by Democrats who recognized it as a good idea.

But as the CBO, which I believe you cited, showed, those kind of tax cuts are more stimulative than anything other than unemployment benefit extensions. And I definitely remember Democratic programs that involved spending other than unemployment benefits, which is to say less stimulative than the tax cuts.

Tax cuts are pretty much by nature regressive, have a poor multiplier compared to direct spending or transfer payments to those in need, increase the economic divide between those households who have an employed earner and those without, and – a concern that is rarely mentioned but important to me – the public does not benefit directly from the spending. I disliked Cash for Clunkers for that reason (and others). If the tax cuts are justifiable on their own merits that’s one thing, but I don’t think anyone here thinks that major cuts in income or payroll taxes are justifiable in and of themselves.

When the government spends, the public should benefit. Tax cuts don’t meet that test nearly as well as direct spending does.

Good ideas aren’t propaganda. They are good ideas.

Good ideas which are not intended to be realized may not be ‘propaganda’, but they are something akin to it.

I have to scratch my head sometimes when I read a post like this, or some comments from the right here at ObWi. It’s weird, because Seb et. al. are clearly sentient, intelligent people. I have to conclude that there is some intellectual inertia going on. Just to clue you guys in: The fringe and the mainstream of the GOP have switched places; the fringe is now the mainstream and vice versa. The GOP is not a serious party anymore, not a party of ‘ideas’ anymore. Wm F. Buckley is dead. Reagan is dead. The 11th Commandment is inoperative. It’s OVER. Much as you dread Democrats, conservatives have much more in common with them then with the dead enders who have taken over the party you used to sympathize with. Face reality, guys.

One thing that seems to get overlooked is the loss of human capital that results from long-term unemployment. That’s why I think it’s better to provide jobs than it is to simply provide unemployment checks. That’s not to say that there’s no place for unemployment benefits; they’re certainly needed in the short term. But what we really need is to get people working again, the sooner the better.

Long-term unemployment is a social cancer. We need some big effing programs that will put people to work and create long-term value, material and human. But anti-government demagoguery over the last few decades may make that nearly impossible, at least until things get desperate enough that people will be willing to give it shot, at which point the whole exercise will be far harder, after we may have lost productive capacity.

This post has a whiff of voñata to it?

I’m really failing to see how the Personal Responsibility and Work Opportunity Act counts as Democrats cutting spending.

I haven’t reviewed the thread comprehensively, so I’m open to correction, but I don’t remember it being invoked as an example of Democrats cutting spending; it was invoked as an example of Democrats (specifically Clinton) compromising and not being punished for it by their own party.

Random thoughts on this careless post:

Warren Mosler of MMT fame has also consistently proposed the FICA holiday. There ya’ go! Ditto Robert Reich.

However, those without employment don’t get much benefit until the spending ripple works its way through the economy….since, obviously, they currently do not pay this tax.

They need jobs. Create jobs.

But really, the poor stimulative effect of the Bush tax cuts are in the history books. Job growth was weak throughout his reign. So why are we even bringing it up?

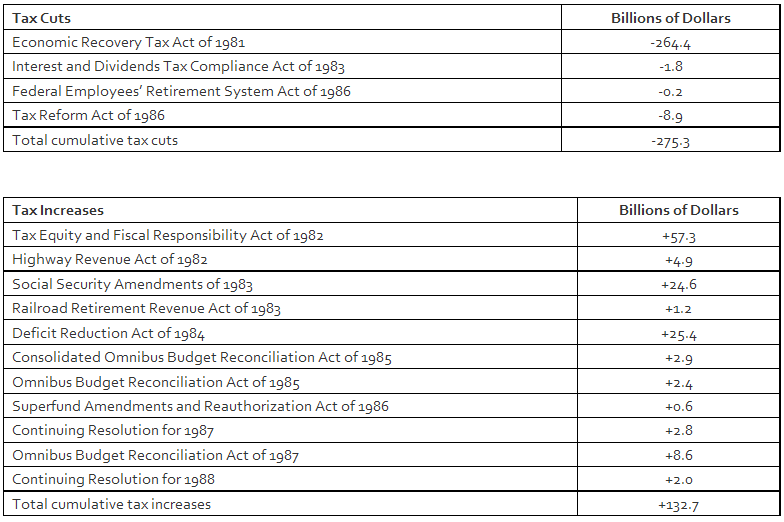

Execrable history:….and further-Once the fiscal disaster that was the initial Reagan tax cuts became apparent, Reagan relentlessly raised taxes.

More bad history: Democrats cut defense spending under Clinton. The reigning in of defense spending was initiated under GHW Bush and continued under Clinton with huge BIPARTISAN support. But don’t let your “hyperpartisanship” get your knickers in a twist.

Huh. See, I thought the official Democratic Party position, at least at the moment, was to continue the tax cuts for those of us under 250k a year. You know, as stimulus. In what universe do tax cuts not count as tax cuts?

But, aside from being completely false, nice argument.

Just to fill out my comment from last night, which I didn’t mean to be ‘bomb-throwing’:

So many arguments from the right here presuppose a reasonable dialogue between the two major parties, as if between two coherent ideologies. That is simply not the case, and hasn’t been for a while. Believe me, I wish it were. Clearly, the situation as it actually is is not good for either party or for our overall politics.

The current GOP is personified by Newt Gingrich. It’s his party, whoever the titular leader happens to be at the moment. Like him, it is grasping, completely unprincipled, incoherent, amoral. In a word, corrupted. Assuming that ideology and practical politics in the current GOP relate to each other in a meaningful way makes for false arguments.

BTW, the idea that no one compromises is simply preposterous, blind. Democrats do little else than compromise, especially in the Senate. It’s their tragedy. Since our system is so rigidly binary, they hold a good share of responsibility for our horrible politics. Since I’ve been saying this for years, I was gratified to read a great post from Yglesias on this subject:

Democrats are earnest enough, and sincere enough (as politicians go!), but they aren’t willing to go to the mat. The GOP is the other extreme – willing to go to the mat for anything, even if the game isn’t worth the candle, even if it damages the country, even if it damages themselves, etc. etc.

Democrats are so easy to ‘play’ that it ends up being bad for the GOP themselves, eventually.

Here here.

In a rational political state of affairs, Seb’s points are worthy of debate, no matter the way in which he frames the points, the disagreement over the substance, or of the minutiae of mechanisms of economic stimulus. There are far more learned minds on these things than me on this forum so I cannot say for certain whether Seb’s onto something, or off the rails (as a number suggest here).

My extremely ballpark stance is that tax cuts might’ve worked better than they did had they been directed entirely at the main thrust of the tax burden. But they weren’t (re hsh). They’ve been directed towards those who don’t circulate the difference in spending (re jhe) because they have no reason or incentive to do so. To the extent that tax cuts have any substantial stimulative effect, whatever effect they would’ve had were targeted inefficaciously.

I’m also, though, with hsh and bobbyp in that job growth might just be at least somewhat more stimulative and make more sense than tax cuts. Again, I’m no economist and I can’t say I’m schooled enough to stand on this – it’s the moral thing to do but we’ve all seen how far morality gets you in this corrupted, soured political climate.

There may be economists who could argue plausibly for tax cuts targeted where they will have the most stimulative effect, and others who could argue plausibly for schemes that spur job growth.

But no-one, in the tenor of our times, is going to listen to them. Republicans cling to tax cuts out of ideology, and Democrats bear triumphantly the stimulus even though I’m inclined to agree that it could never have been more than temporary. But anymore, even a temporary measure rooted in plausibly-crafted policy is better than ideological posturing, which is rooted in pure fantasy.

The only thing I feel safe to go after here is Seb’s careful skirting around tax cuts as equally temporary. I truly hope he’s not buying into otherwise, because if the stimulus is a stop-gap measure, tax cuts have a shelf life equally as plausible.

Just to finish up…

I accused people who lean Republican of being victim to some sort of cognitive inertia, and just want to add that, obviously, Democrats have the same type of problem: they think there is still a basic consensus of some kind in DC, and behave as if there were. Wrong.

Our politics reminds me a lot of a nasty divorce (like one of Newt’s in fact!). One party to it is the Asshole, who will do anything to get what he wants; he said he loved you, but it was romantic love (love of self); now his ‘love’ is become pure hatred, and he will trash you and everything else to get what he wants, even if he doesn’t really KNOW what he wants (John Lydon: ‘I don’t know what I want, but I know how to get it’). The other party is in shock; can’t believe that all those years of partnership suddenly mean nothing; can’t believe that the vulnerable human she knows is ‘in there’ can’t be summoned, etc.

She has the high ground, and if there *is* a long run, she has the stronger position. But she and/or children might very well be destroyed in the short-run if she doesn’t face reality: The ex-husband is an asshole, it is not her job to ‘redeem’ him, and she *must* fight for herself.

It is the cheap province of MoDo and Anne Coulter to Genderize politics at every opportunity, and I don’t want to be like them. (For one thing, it would’ve been perfectly valid had I reversed the genders in my little scenario – but, let’s face it, it’s usually this way around (certainly in Newt’s case)). I do think, though, that there’s a bit of truth in it. Two-Party politics in the US is devastatingly symbiotic, and everybody talks past everyone else, as in a rancid divorce.

“Execrable history:….and further-Once the fiscal disaster that was the initial Reagan tax cuts became apparent, Reagan relentlessly raised taxes.”

This is mystifying. At the end of Reagans term the top marginal tax rate was 28%(after the tax overhaul of 1986). It was raised in 1990 to 31%. I have read here at least a x (it was a big number) times how we are just raising rates to the level of the Reagan years. However, I don’t see that except the tax rates he started with and vigorously worked to reduce with cuts in 81, 83, 84 and 86.

No one relentlessly raised taxes between then and, well, now.

And, as for Republicans sticking to tax cuts out of ideology while all those Democrats raise taxes and increase government spending because they have “new” ideas, that’s just crap.

I have been listening to the same old tired Democratic tax and spend ideology since Johnson took over for Kennedy (a big tax cut guy). They now get to talk about it like it’s new because they have a few new generations to sell it to. The Democrats are just as ideologically tied to their set of solutions as the Republicans, and just as unyielding.

More “pox on both their houses” from the right.

At the end of Reagans term the top marginal tax rate was 28%(after the tax overhaul of 1986)

Yes, and for the first six years of Reagan’s Presidency the top marginal rate was 50%. Initially that kicked in at $85,500, over the next couple of years the threshhold was raised to $175,250.

In tax year 1987, the top marginal rate was 38.5%, kicking in at $90K.

And at the end of his Presidency, the *highest* marginal rate was 33%, not 28%. It just didn’t apply to the highest income earners. The second highest income bracket paid a higher marginal rate than the highest, in what is to my knowledge the only case of an explicitly regressive income tax regime in this country.

The Democrats are just as ideologically tied to their set of solutions as the Republicans, and just as unyielding.

Works for me. I only wish they were about 1,000 times more unyielding.

More than that, I wish they were prone to occasional fits of wild, reckless overreaching.

Boldness has genius, power, and magic in it. We could use some of that.

As far as bipartisanship goes, I say screw it. You advocate for the result you want, I’ll do the same, and we’ll see who prevails.

Payroll tax?

OK, I think you’re right, FICA is also a tax that’s tied to income.

So, Reagan and Bush I’s income tax regime was the second explicitly regressive one.

Thanks Ronnie and Poppy!

For Marty:

Reagan’s Tax Increases

I really don’t care if you think that the excellent idea was offered in some sort bad faith. (Though the format of the bad faith is confusing and you don’t seem to be able to agree on it.) Pretty much the only things more stimulative than FICA tax cuts are unemployment benefits and food stamps–neither of which are much scalable past certain limits. So once you have those in place, if you skip over the FICA tax cuts into longer term spending you hit the dead-weight problem for no reason (remember Saez estimated that at about 38%) and you are offering stimulus that isn’t as fast acting.

There is no reason why Democrats can’t take a good idea just because it is initially offered by a prominent Republican.

And most of the opposition here is grounded in the fact that it came from a Republican. Nearly all of the economists you trust on the stimulus say that it would be very useful.

If you’re opposing a good idea because it came with an (R), you’re part of the problem.

If you’re opposing it because you worry that you will have political trouble reversing it later, then at least you have a rational reason. But in that case, the dumping on my post seems rather overblown…

“If you’re opposing a good idea because it came from a Republican (R), you’re part of the problem.”

Speaking for myself, no.

The two so-called Republicans (my parents and grandparents were Republicans, you are nominally republican — these guys aren’t Republicans) whose names have come up are Gingrich and Gohmert, one an unbalanced sociopath and a liar (and that’s BEFORE we get into his personal life), and the other a complete whackjob who believes baby Muslims are actually making bombs as we speak in their baby carriages and who compares gays to Hitler and his minions and to beastiality.

Sebastian, YOUR good idea can be opposed on principle.

Their good ideas are traps, sinkholes of demagoguery, promises made with ghastly smiles regarding Social Security (a program they hate and want destroyed), later to be broken when the FICA tax holiday expiration rolls around.

Find better co-sponsers for your proposals.

When I come around here and begin a comment with “James Traficant, my fellow Democrat, had a good idea yesterday,”, I hope to shout you’ll ignore it (that would be nothing new … but humor me)

Gingrich and Gohmert would have been Confederate Democrats 40 to 60 years ago. The “D” behind their names wouldn’t have swayed me.

Democrats passed Romneycare this year and were vilified (by Republicans, including Mitt Romney) for it.

Much of the dumping on your post appears to be driven by the false equivalence you draw between the two parties. It’s incorrect and gives the Republican party much more credit than it deserves.

Also, too: John Thullen for President in 2012.

*shrug*. This is just more Broderism. Pointless appeals to bipartisanship, to a “middle ground”.

It is firmly rooted in two deep fallacies — the fallacy that the middle ground between two opposing stances is always the right choice (maybe yes, maybe no) and the belief that both parties are negotiating in good faith.

Democrats took Republican ideas, wrote a health care bill that was pratically the GOP’s own 1990ish proposal, and got….told their were going to kill grannies across the nation for being too costly.

I love your theory-crafting, Sebastion. But you might want to ground it in a little bit of reality. At least a disclaimer of “If we lived in a sane world” at the beginning.

Although, hey, I’m starting to grasp that critique about ivory-tower intellectuals. Your points certainly sound smart. I just can’t help but notice that, in the halls of actual government, the GOP turns on it’s own ideas, lies about them, and uses them in attack ads against any Democrat with uses them.

From Ellen Willis’s “Glossary for the Eighties”:

DOGMA: a political belief one is unreasonably committed to, such as the notion that freedom is good and slavery is bad.

BIAS: predeliction for a particular dogma. For example, the feminist bias is that women are equal to men and the male chauvinist bias is that women are inferior. The unbiased view is that the truth lies somewhere in between.

(That’s all I could find online, but there’s another one about an ideology being a collection of dogmas; not to be confused with “ideas,” which are common-sense propositions like “the truth lies somewhere in between.”)

“John Thullen for President in 2012.”

See McKinneyTexas regarding enemas and flossing with barbed wire.

Besides, I don’t think the country could handle having the Lincoln bedroom converted into a torture chamber and the screams in the dead of the night (live-feed on the new C-Span public access channel –“c” standing for commeuppance)from the likes of Limbaugh, Hannity, Liddy, Savage, Angle, Erickson, Gingrich, Norquist, Beck (I’ll bet he is an extravagant screamer and fairly yodels at the slightest bit of pain), etc.

First term — vengeance … with paperwork.

Second term — Sebastian and various others invited to the Oval Office with this greeting “Now, I understand you good people have some constructive ideas about turning this country around.”

Somehow, I don’t think my candidacy will fly.

Not with that attitude, it won’t.

“Vote for Thullen. He will f*** your s*** up.”

Sound crazy, but it just might work!

Bruce Bartlett is succinct:

Beck (I’ll bet he is an extravagant screamer

For sure. I’m constantly struck by how hilariously fey Beck is for a “conservative” pundit. When he gets into his “silly” mode he makes Charles Nelson Reilly look like The Rock.

Oh wait…you meant that kind of screamer.

Never mind.

“It is firmly rooted in two deep fallacies — the fallacy that the middle ground between two opposing stances is always the right choice”

Except it isn’t. The FICA tax break is considered superior to almost all of the other stimulus (other than unemployment benefit extension and food stamps) in both efficiency and speed.

It isn’t halfway in between the Republican and Democratic proposals. It is a policy which is superior to most of the Democratic proposals, and is superior to nearly all of the other Republican proposals.

“Your points certainly sound smart. I just can’t help but notice that, in the halls of actual government, the GOP turns on it’s own ideas, lies about them, and uses them in attack ads against any Democrat with uses them.”

So that means you shouldn’t use good ideas! Right?

Note to Democrats: Republicans are already opposing your ideas. They are opposing your bad ones and your good ones with equal intensity so far as I can tell. So why not stick to the better ones and let them oppose you there? I’m not suggesting that you use the FICA holiday to grab Republican support. I’m suggesting that you blatantly steal it, and use it as your own because it is a good idea.

Rejecting good ideas because they came from the wrong tribe isn’t the way to craft good policy.

What happened to ‘same facts’ or ‘reality-based community’?

Are you so scared of the Republicans’ shadows that you can’t analyze good policy because you are paranoid about the tricky double fake?

I’m suggesting that you blatantly steal it, and use it as your own because it is a good idea.

Works for me.

Sebastian,

When evaluating an idea, I like to be clear on what the idea IS. There are at least 4 possible variations of a “temporary FICA holiday”. The 4 that I mean are in a 2×2 matrix: employer/employee vs. Treasury/SSA.

The variation that I support is: employee-side holiday, Treasury reimburses the SS Trust Fund. If that’s the good idea Gohmert and Gingrich are pushing, great! If it’s not, then I oppose whatever their “idea” is. But not because of who is proposing it.

–TP

When they stop shooting at my sillouette during campaign functions, I’ll stop being scared of their shadows.

I’m not scared of Dick Lugar’s shadow. What’s his take on a FICA holiday?

He’s like the Imam Feisal Abdul Rauf of the Republican Party, by which I mean I can tell the difference between him and the bad actors who have hijacked the Republican Party.

“Proverbs for Paranoids:

1. You may never get to touch the Master, but you can tickle his creatures.

2. The innocence of the creatures is in inverse proportion to the immorality of the Master.

3. If they can get you asking the wrong questions, they don’t have to worry about answers.

4. You hide, they seek.

5. Paranoids are not paranoid because they’re paranoid, but because they keep putting themselves, f*cking idiots, deliberately into paranoid situations.”

— Collected from Gravity’s Rainbow, Thomas Pynchon

“Paranoia is knowing all the facts.”

Woody Allen

“This is the Nineties, Bubba, and there is no such thing as Paranoia. It’s all true.

Hunter S. Thompson

There are at least 4 possible variations of a “temporary FICA holiday”. The 4 that I mean are in a 2×2 matrix: employer/employee vs. Treasury/SSA.

We already have the employer side version, at least for new hires of previously unemployed people.

I don’t know whether Treasury pays SS back for the lost revenue.

We already have the employer side version …

Did we steal that idea from the Republicans, or ram it down their throats?

I forget:)

–TP

Why choose? I’m sure it was both.

Did we steal that idea from the Republicans, or ram it down their throats?

I forget:)

Another little joke which sums up a lot, TP!

“Pretty much the only things more stimulative than FICA tax cuts are unemployment benefits and food stamps”

Both of which have recently been slashed, in case you hadn’t noticed, by folks who call themselves Democrats.

Did we steal that idea from the Republicans, or ram it down their throats?

Don’t know whose idea it was.

The vote in the House was 217-201, with all but 6 Republicans against.

The vote in the Senate was 68-29, with 11 Republicans joining all of the Democrats except good old Ben Nelson to pass the bill.

So, Republicans overwhelmingly voted against a tax cut for businesses.

Yup, it must have been their own idea originally 🙂

–TP

Recently one leading GOPster in Congress actually said that a certain plan was his idea but the fact that Obama adopted it made him change his opinion (i.e., if he likes it it must have been a bad idea in the first place). Sorry, I forgot which GOPster and what it was about but it was at least one step up from the usual “We vehemently oppose this and always have. What do you mean, we wrote this bill and fought for it just yesterday? Why do you hate America so much?”