by hilzoy

Possibly because of my immersion in posts about going Galt, I've read altogether too many blog posts and newspaper columns about the horrid, wealth-destroying, class-warfare-waging, socialist nightmare that is Barack Obama's tax policy. So I thought it might be a good idea to get a few basic facts on the table.

Obama is not proposing to raise the personal income tax. He is proposing to allow the Bush tax cuts on families making over $250,000 a year to expire. The Republicans wrote that expiration into law to conceal to hide the costs of their tax cuts. Under the law they wrote, the top marginal tax rate will go up from 35% to 39.6% in 2011.

If a top marginal tax rate of 39.6% is socialism, then there are a lot of socialists in the world. For instance, Japan, South Korea, Australia, along with a lot of the OECD: all have rates higher than Obama is proposing. (Note: I just chose some countries at random. I'm sure I could have found more.) No wonder the world economy is in trouble! There's socialism and class warfare everywhere you look!

But it's even stranger than that. Did you know that Margaret Thatcher (pdf) declared war on the wealthy, a war so extreme it makes Obama's seem meek by comparison? The top tax rate in the UK was 60% for most of her term in office, and 40% for the last year or so. At no point was it lower than what Obama proposes — and that's without taking into account the VAT.

Likewise, Ronald Reagan was apparently a Class Warrior: for six of the eight years during which Reagan was President, the top tax bracket was 50%. It's a wonder anyone worked at all! In Reagan's defense, though, he was just carrying on a long tradition of wealth expropriation carried out by socialists like Harry Truman, Dwight D. Eisenhower and John F. Kennedy.

All in all, it seems as though we've been suffering through an awful lot of socialism and class warfare all over the world, much of it at the hands of people conservatives claim to admire. If a top marginal rate of 39.6% is enough to make society's producers and creators go on strike, then Galt's Gulch must be getting pretty crowded.

So, are conservatives afraid of socialism, or is it the WORD socialism that has become a big bogyman ?

Intox. Intox. Wherever you look.

Words are rallying points, aren’t they ?

So, when are we going to start using our intelligence ?

It’s the word. Conservatives, Republicans, and Americans in general are prefectly happy to support socialist style programs and policies if they see themelves as the primary beneficiaries. In fact, there are more socialist style programs and projects in place in the red states or red parts of states than else where. In Washington, for example, Bonneville Power is the basis for the eocnomy the red part of the state along with subsidized access to public owned grasslands and forests.

No, Republican politicians don’t appeal to intelligence when developing their talking points. They appeal, one way or the other, to selfishness.

How soon we forget.

I don’t recall where I found it, but here is a bar graph showing the top tax rates annually since 1920. As I recall, the Reagan tax policy was a “simplification” from multiple progressive levels to three, which had the effect of eliminating the really high rates for those most able to afford it. Pretty slick move on the part of The Great Communicator, no?

I’m in favor of returning more layers. Since the advent of the three-tier system we have seen the growth of truly obscene incomes at the top.

One of the memes that frustrates me most is dumping off an those who “pay no taxes at all” referring to those at the very bottom of the economy who don’t earn enough to offset the standard deduction, but still get stuck with state sales taxes, various excise taxes and the biggie: payroll taxes from the first dollar they earn with no deductions.

International Women’s Day Action

Global Gender Caste Action

Please tell your friends about the petition.

http://www.petitiononline.com/savenow/

To: U.S. Government and United Nations

We call upon America’s government representatives and the international representatives of the United Nations to recognize the global threat of oppression and violence to women from Islamic supremacism.

We demand that they pass national and international resolutions condemning Islamic supremacism as a threat to women everywhere. We demand that these world leaders recognize the existence of Islamic supremacism, and we demand that they take measures to protect the women of the world from the Islamic supremacist ideology.

Women are being oppressed, beaten, murdered in America and around the world in the name of Islamic supremacism. Being “sorry” is not enough. We call upon the leaders of the world to take responsibility to SAVE WOMEN NOW from this cruel, vicious, and deadly ideology of Islamic supremacism.

Sign Here

http://www.petitiononline.com/savenow/

Read more about the action here involving 2 marches – in London and Wash DC here:

http://pajamasmedia.com/phyllischesler/2009/03/04/save-women-now-the-march-8th-washington-dc-rally-means-muslim-women/

Congressman Roy Blunt of Missouri described Obama’s health care initiatives as akin to going down to the DMV, and y’all know what that socialist paradise looks like.

Here’s what it looks like, Roy, as of last Wednesday. Short lines, a cheerful, efficient public servant who processed my registration paperwork in a trice and I was on my way. This despite the fact she isn’t paid enough, and her state retirement 401K probably looks as small now as Bernie Madoff’s black heart.

Also despite Republican efforts over the past twenty years to gut the DMV budget and close as many offices as possible so that the State’s most obvious point-of-sale could become a negative object lesson for the government-hating public.

I was half tempted to ask her for a preventative medical exam, too.

Now, go read Karen Tumulty’s piece in TIME about her brother’s healthcare ordeal in the great Randian wasteland of Texas.

I’ve decided there is a reason America prefers to bury their dead in individual graves with seeming dignity. It covers up the evidence.

If we buried the millions of people who are caught in this atrocious healthcare system and die early because of it in one big, fetid mass grave, we’d at least bear witness to how America’s healthcare system for the poor and uninsured and underinsured should simply be named SADDAM.

I think what Blunt and ilk are really afraid of is that Americans are too imcompetent, stupid, and bereft of the values to pay for and run a decent healthcare system that works.

He might be right.

Isn’t your argument, at the very least, incomplete? You don’t address the payroll tax at all. You don’t address Obama’s plans to increase the payroll tax on the top rates. You don’t address Obama’s proposals to change to the rules on deductions for the top rates. You don’t address deductions. The only thing you note that many countries have a VAT, but you don’t note the sales, state, local, and other taxes that vary from country to country.

In the past, Hilzoy, you’ve been careful to note that merely focusing on the Capital Gains tax rate creates a misleading impression regarding the actual taxes paid on capital gains. You have to look at the entire picture. I can’t think of a legitimate reason for you to be less careful when doing a comparison of income tax rates. Nor can I think of a legitimate reason for you to ignore the proposed payroll tax increases or changes in deductions.

Can you?

I’m in favor of returning more layers. Since the advent of the three-tier system we have seen the growth of truly obscene incomes at the top.

What’s an “obscene income”?

von: What’s an “obscene income”?

The average Wal-Mart employee earns $17,114 a year before tax. Wal-Mart health insurance only covers 43% of their employees, and Wal-Mart has approximately 1.39 million US employees. (cite)

The Walton family own $90 billion dollars of stock. (money.cnn) David Glass, CEO of Wal-Mart, is paid over nine million dollars a year.

That’s an obscene income.

Sorry: I wrote “capital gains tax rate” above when I clearly meant corporate tax rate. Blame it on the loss of an hour’s sleep last night due to DST — a fact that might also explain the significant holes in Hilzoy’s post. (Need …. more …. sleep.)

OK, what should Glass earn?

OK, what should Glass earn?

How about: the CEO of a business should earn no more than 40 times what the average employee of the business earns? That would give Glass an income of $684,560 per year before tax. In 2005, approximately one and half percent (1.5%) of households in the United States had incomes exceeding $250,000.

I didn’t just make the “40 times” up: though I can’t right now recall where I got it from. Wal-mart’s average pay is not much above the federal poverty level for a family of four – and the federal poverty level doesn’t take into account all basic needs. Glass earns over 36 times more than someone at the bottom end of the top 1.5% percentile.

You asked what was “obscene” and I’m giving you an example drawn from a specific company. I say that’s obscene. You’ve got another word for it? What?

I don’t find Glass’income obscene. More power and money to him.

I find the average Wal Mart employee’s income obscene. Much more power and money to them.

Yeah, I know. Prices will rise.

Then how about this? Don’t pay the employees at all, which would reduce prices to zero, benefiting all of us. Especially Glass, who if he had saved his $9 million a year for the past many years, could be paid zip, too, going forward.

I also find it obscene that Wal Mart shareholders and management expect the average Wal Mart employee to be obscene and not heard, especially on the unionizing front.

What is actually pornographic is the time and effort a guy making 9 million dollars and a family worth 90 billion put into skimping on health insurance benefits for their employees, not to mention the time and money put into lobbying against a rather mild tax increase.

Yes, I know all of this betrays an obscene lack of economic understanding on my part.

But every time I listen to folks explain why things must be this way in the tough rational world, I know pornography when I see it.

I find the average Wal Mart employee’s income obscene. Much more power and money to them.

As ever, you put things much more wisely than I do.

Also, you know: 40 times the average employee salary isn’t even a reasonable limit. It’s an unreasonable limit. It would still make David Glass one of the highest paid employees in the US, for a company that pays most employees at the poverty level or below. But at least it would be some kind of limit.

What is actually pornographic is the time and effort a guy making 9 million dollars and a family worth 90 billion put into skimping on health insurance benefits for their employees, not to mention the time and money put into lobbying against a rather mild tax increase.

I think calling that “pornographic” is an insult to honest, direct pornography merely intended to give your average wanker a stimulus.

Tsk, tsk. Hilzoy, it really is outside of too much to go injecting actual facts into such an enjoyable bout of hysteria! How can we get properly worked up if people keep injecting reality into the discussion????

Next you’ll be suggesting that people ought to actually, you know, think — and for themselves at that. Then how would they keep the one true faith?

von: I thought your comment made more sense the first time, insofar as it would seem to be individual tax rates that would make someone Go Galt. I didn’t include the fact that itemized deductions would be capped at 28%, and that capital gains taxes would go up from 15 to 20%, for two reasons: first, neither would have much effect on the Going Galt thingo (deductions cap would mostly affect people’s decisions about whether to do the deductible activity; cap. gains would still be taxed at just over half the level of normal income); and second, while I wouldn’t have made the international comparisons without knowing that the tax burden on the top bracket in Thatcher’s UK, for instance, was bigger than anything Obama has proposed, I didn’t want to get into the zillion and one different taxes in each of the countries I mentioned.

If you think this affects the overall point, do let me know how.

About that “obscene income” thing. I’m guilty of using a figure of speech that flew way over at least one head. I take it back. Play like I’m a Supreme Court justice saying “I know it when I see it.” I was commenting on progressive taxation, not earnings tiers.

von also mentioned the payroll tax rate which raises a couple of interesting points.

First, the cap on the “Medicare” tax was removed several years ago. My Social Security earnings statement reflects having paid the max into Social Security over twenty years, but not the Medicare portion. For my entire working career and beyond (including this year and next, btw) more than enough payroll taxes were collected than required and that SURPLUS was spent, replaced by a slick accounting tactic called the “Social Security Trust Fund.”

Second, the smoke and mirrors device called “employer contribution” is nothing more than another accounting device to mislabel earned income. For every dime “contributed” by an employer, someone earned another dime. If the earned dime didn’t exist, neither would the “contributed” dime. Ergo, the payroll tax is actually fourteen percent. The company subtracts employee wages as a business cost plus the so-call “contribution” portion as well. This sounds crazy to most people, but self-employed people understand it perfectly.

The larger point is that progressive taxes do not leave those at the bottom untaxed. A large and growing population filing returns with standard deductions pay a very regressive flat payroll tax from their first earned dollar.

“Short lines, a cheerful, efficient public servant who processed my registration paperwork in a trice and I was on my way.”

As I mentioned here at the time, that was my experience some 9 months or so ago, too. I was in and out in five minutes (getting a State ID, a non-driver’s license).

“Also, you know: 40 times the average employee salary isn’t even a reasonable limit. It’s an unreasonable limit. It would still make David Glass one of the highest paid employees in the US, for a company that pays most employees at the poverty level or below. But at least it would be some kind of limit.”

I’m not interested in putting upper limits on income (though I’m fine with increasing the progressive tax rate sharply at immensely high levels). Like Thullen, I’m interested in seeing everyone be raised over the line of poverty, and being able to afford adequate food, shelter, health care, child care, and other minimal basics for a decent life.

This is America: we can afford that. And still have oodles of very rich people, and people in between the rich and the poor.

If you think this affects the overall point, do let me know how.

Well, because you said that you were putting “a few basic facts on the table”, and then left out some highly significant facts.

Moreover, it affects the argument. OECD routinely does the kind of comparative tax studies that I think you should consider. They are available as Excel spreadsheets here: http://www.oecd.org/document/60/0,3343,en_2649_34533_1942460_1_1_1_1,00.html#table_I4) In 2007, with the Bush tax cuts in place, OECD calculated the “all-in” US tax rate (federal only) for the top bracket as 42.7%. That includes FICA and accounts for deductions, but fails to account for state or local taxes. That’s slightly higher than the comparable UK top bracket (41.0%) and roughly comparable to Spain (43.0) and Austria (42.7).*

Now, mind you, that’s taking into account the Bush tax cuts. If those cuts expire, and you add in a FICA donut, and you eliminate deductions — all as Obama plans to do — the US top bracket will likely be significantly higher.

deductions cap would mostly affect people’s decisions about whether to do the deductible activity; cap. gains would still be taxed at just over half the level of normal income

1. The deduction rule changes will also affect a persons desire to have taxable income above 250k. If you exceed the maximum deduction under plan Obama, there would be a big incentive to ensure that reported, taxable income remains under 250k. (I leave aside the whol “going Galt” foolilshness …. I’m talking plain-vanilla tax avoidance creativity, both legal and illegal.)

2. I didn’t intend to mention cap gains — I was talking about Obama’s bump up in FICA for the more than 250k crew. Obviously, the capital gains and corporate tax increase will further increase the relative tax burden on individuals.

Anywho, your post works as a bit of agitprop – which is fitting, since the going Galt BS is agitprop for some on the right. Still, I submit that it ain’t the kind of discussion we should be having regarding Obama’s tax plans.

von

*By the way, according to OECD, South Korea has a top statutory tax rate [income + SS/Med] of 38.5, with a “all-in” rat of 38.3. Contrary to your post, under the Bush tax cuts the US had a higher marginal rate than South Korea. The gap between US and South Korea will increase if Obama’s plan gets passed.

(I might be mistaken, but I think you misread the page on South Korea that you linked: as I read your linked article, that a 50% marginal tax applies to non-residents.)

By the way, if you look at the OECD’s detailed comparisons, you’ll see that the US “all in” top marginal rate is not really an outlier under Bush. It probably also won’t be an outlier under Obama, although our all in burden will increase.

The US is a huge outlier, however, in the threshold AW for the top marginal rate (8.7; the next highest is Germany at 5.9, and then every other country is below 5). In other words, you need to make a lot more money in the US to hit the top marginal rate than in other places.

Obama’s plan does nothing about that disparity. To the contrary, Obama would make the disparity more significant by promising tax cuts for folks in lower brackets.

This is one significant basis for the “socialism” charge, which you don’t address. Under Obama, 44% of the population will either pay no income taxes; many will actually receive money under the income “tax”.* (Many of these individuals will continue to pay FICA, however.) Meanwhile, the relative tax burden will shift within the 56% of people who do pay taxes from the low end to the high end. That’s a significant redistribution of income, and it’s something that is not captured in the kinds of comparisons that you’re making.

We are creating an income tax system in which the tax burden is falling more and more on a smaller group of people, while an increasing number are paying little or no income tax. I don’t know if that’s a good idea.

*http://www.economist.com/opinion/displaystory.cfm?story_id=13237211

You don’t address the payroll tax at all.

The only concrete thing I’ve seen for this is 2-4% on income over $250K.

You don’t address Obama’s plans to increase the payroll tax on the top rates.

If I understand this issue correctly, what Obama is proposing is not eliminating the existing PEP/Pease program, originally introduced under Bush 1. Again, if I follow it correctly, we began removing the PEP/Pease deduction limits in 2006, and they are scheduled to be completely removed in 2010.

Obama proposes restoring them. Or, more correctly, not repealing them.

They’re nothing new. They’ve been in place since 1990. And, again if I understand all of this correctly, their repeal was also intended to expire at the end of 2010, along with the rest of the tax cuts introduced by Bush I in 2001.

Net/net — even with the FICA and deduction stuff factored in, Obama’s proposals represent, at most, modest increases in the tax burden. They are noise when considered in the context of the difference between the US tax burden as compared to other OECD nations, or to the US in historical terms.

Nobody’s getting skinned.

I won’t be happy until the top marginal rate is back at 92% where it belongs and where it was when the US economy was enjoying GDP growth rates not seen since then.

Don’t like it? Move to Somalia. Nothing is less interesting than a rich person in one of the richest countries on earth whining about taxes. I simply refuse to hear it.

“We are creating an income tax system in which the tax burden is falling more and more on a smaller group of people, while an increasing number are paying little or no income tax. I don’t know if that’s a good idea.”

How does it compare to historic U.S. trends in income tax spread, Von?

I agree with Von that all income earners should pay income tax, albeit in a progressive system.

This would give all citizens a stake in citizenry.

Unfortunately, the American culture of hating taxes, demagogued endlessly since day one (you know what I hate: paying for food) has given us the small percentage of folks who pay the large percentage of taxes.

Progressives distribute taxation upward because Newt Gingrich would be on the tube demagoguing the very idea of paying taxes and those with lower incomes would eat it up.

Leaving aside FICA, I’ve always thought a flat income tax was an elegant idea. Except for this: Steve Forbes and the other advocates were counting on the idea of a flat tax as a way of making as many voters as possible angry about taxes and government.

By the way, I’d be just as happy to tell a person making $35,000 to shut up and stop whining about taxes as I would a whiner making $35 million.

von,

Could you check the link for the OECD figures? It doesn’t seem to work.

Also, what’s “AW,” in “The US is a huge outlier, however, in the threshold AW for the top marginal rate?”

Thanks.

State control of the means of production is IMHO the main hallmark of socialism. One of socialism’s goals is income egalitarianism.

Raising the top marginal tax rate is not in itself an indicator of socialism. However, doing so in order to furnish a cash rebate to lower income citizens is in the direction of forced income egalitarianism.

State ownership of important industries and the degree of control that comes with it is in the direction of socialism. (Banking, Autos, Insurance).

Putting ceilings on the compensation of high earners is in the direction of forced income egalitarianism.

//As ever, you put things much more wisely than I do.//

Jesurgislac indicates Thullen is wiser. Wow.

“State ownership of important industries and the degree of control that comes with it is in the direction of socialism (Banking, Autos, Insurance).”

This is probably true and I really don’t know a single person who is in favor of full state control of industries (except for the role of paying for health insurance).

But your statement is a little like saying “entering the hospital to treat cancer and the degree of control that comes with it is in the direction of chemotherapy.”

That’s true too. Also, “not entering the hospital to treat, etc. etc. etc. is in the direction of the graveyard.”

We could have permitted a little bit of regulation over the massive shadow banking system and we may have avoided or have been inoculated against much of this mess.

We weren’t permitted to do that for strict ideological reasons.

So, I’d say ya’ll better get that festering, malignant metastizing tumor looked at as soon as possible.

Sorry, but it’s going to hurt.

I’m open to a tax hike on my greater wisdom.

Distribute the money to the stupid.

Even stupid people should have health insurance.

By the way, I’m not particularly wise, despite Jes’ nice words.

I’m as clueless as they come.

Mr. Yomtov re link

All that is missing is .htm at end.

dave,

That got it.

Thanks.

“State ownership of important industries and the degree of control that comes with it is in the direction of socialism (Banking, Autos, Insurance).”

And yet it’s the very conservative Bush administration that did this. It’s not as if there’s hardly anyone in the Democratic Party who thinks that public ownership of the auto industry, the insurance industry, the banking industry, is a good idea. Only some tiny fringe thinks that, and they’re just about invisible.

Both Dave and John Thullen make several valid points regarding the issues of socialism and healthcare. Gary’s observation that the Bush administration made the first moves (wrong moves btw) to establish state ownership of the industries in question is correct, although I would quarrel with his descriptor of it as very conservative. I would be quicker to agree with a description that it and elected republicans in general have been in the pockets of big business for some time.

The thing now is that the Obama administration is continuing to prop up the financial and auto industries with public money without any clarity as to where these actions will lead us. And the galling thing to those who do not support a federal takeover of health services is to have almost three quarters of a trillion dollars of new spending in the budget submission for healthcare initiatives and have the administration assert that an economic recovery cannot occur without a revamping of the healthcare delivery system. Hogwash!

The shift of responsibility for universal healthcare to the federal level is an issue that should have extensive and very specific debate before any funding is committed. The Democrats almost have the numbers now to force it through, but it might not be the wisest tactic. I know the progressives believe they have the electorate behind them on this issue, but if they are wrong? Well, let’s just say they are all in.

My own contribution rate is actually higher marginally than someone making 500K – as there’s the 14% of social security tax they’re not paying (roll in the employer part, it’s all the same) and 28% + 14% > 35%. 39.6% too…

The big giveaway is the capital gains and dividends tax cut… because most of the really big ‘earners’ contrive to have most of their incomes taken in this way. This very fact probably has had a toxic effect on corporate governance – you engineer things so that you get intermittent bonuses and other tax-engineered windfalls that only appear at some sort of lower rate.

Warren Buffett observed that his own effective federal marginal rate was about double that of his secretary’s.

There’s only so long the Plantation Party can keep playing their game…

OK, what should Glass earn?

First, let’s agree that “earn” is a colloquialism. Von is asking what the CEO of WalMart should be paid. I raise this bit of pedantry because the whole point of free-market capitalism is that employees are paid what they can get, not what they “earn”. WalMart would not have $9 million to pay its CEO every year unless the average WalMart worker earns more, for WalMart, than the $17K the average worker gets paid by WalMart. Without those low-paid workers in the stores, WalMart would earn nothing. The Walton family fortune would be considerably smaller, had WalMart paid its workers, from greeters to CEOs, what they “earn” over the years.

Second, let the Waltons pay Glass any goddam salary they like. That’s my position; maybe Von’s too. The reason they pay a greeter $8/hr is because they can’t get greeters for less, and the greeters can’t get a comparable job elsewhere for more. We can assume they pay CEOs on the same principle. WalMart is the Waltons’ fiefdom; they know how to haggle; let’em pay anything they like to their CEO.

The issue for us is not how much a greeter or a CEO should be paid, but how much to tax each of them.

Note that if we take it into our heads to raise the “all in” taxation of $9-million-a-year incomes to 60%, or even 90%, we do not “distort” the market for CEOs. Glass can demand a raise from the Waltons; the Waltons can invite Glass to find a higher-paying CEO job elsewhere; this obtains no matter what the personal income tax rate is. Any CEO looking for a job will face the same tax rate; any company looking for a CEO will face the same tax rate. Neither Glass nor the Waltons are singled out.

There’s nothing obscene about the Waltons shelling out $9 million a year for somebody to run their business for them. Even if Glass can successfully extract $90 million from the Waltons for his vast skill and boundless effort, it’s not even mildly offensive to me.

What is obscene is the idea that someone who gets paid $9 million a year, or a family that amasses a $90 billion fortune, must not be taxed too much lest they chuck it all and become $8/hr greeters just to spite us.

–TP

it’s not as if there’s hardly anyone in the Democratic Party who thinks that public ownership of the auto industry, the insurance industry, the banking industry, is a good idea.

I’m on the fringe, then. Banking and insurance should be government run. The government already takes the risk, either explicitly or implicitly for those industries. It just doesn’t get any of the profits. Screw that. Socialize them. You could have reasonably argued against it two years ago. Those days are gone.

The reason they pay a greeter $8/hr is because they can’t get greeters for less, and the greeters can’t get a comparable job elsewhere for more. We can assume they pay CEOs on the same principle.

That would be a very bad assumption.

‘What’s an “obscene income”?”

An income where, upon seeing it, one is compelled to utter “oh, f**k!”?

now_what,

Is the “very bad assumption” the one that “they pay CEOs on the same principle”?

If yes, what’s a better assumption?

Mind you, I am perfectly willing to believe that the small fraternity of people who consider each other CEO material, sit on each other’s boards and compensation committees, and basically set each other’s salaries, are ripping off their employers. More than willing to believe it, actually. In a way, glad to hear it:)

–TP

Von,

I don’t think the site you referenced supports your point. If you look at Table 1.1, EU workers pay even higher taxes than workers in the US if you factor in Social Security payments. And with a VAT rate over 30% for certain goods and services, you’re talking about an additional tax that far exceeds any sales tax rate in the US.

When Reagan took office, the average CEO pay was 40 times the lowest wage in their company. I think that’s where the 40x comes from.

What I think is missed from the discussion is the more obvious remedy to all of the overtax whining. Rather than raise the tax on the top bracket, we should raise the salary of the lowest brackets to move those people into the income tax ranks.

Give executives a choice – we can either bring in higher tax receipts with a higher tax on the wealthy or we can do it by raising minimum wage to $16.15/hr (the bottom of the 25% bracket, which would put most of their income in the 15% bracket). They can pick. Have a big summit in an arena somewhere.

I’ve similarly had nothing but prompt, courteous service every time I’ve needed to go into the motor vehicle department in PA. But I know it’s not like that everywhere.

My most recent “DMV-like” experience was when I had to get my birth date corrected on my social security record, and was forced to go in person to a social security office. The one I went to, near my work but in a poorer neighborhood, had all the long and impersonal waiting of the stereotypical DMV. And after a few minutes it was fairly clear why: there weren’t nearly enough customer service staff to handle the volume of people coming in who wanted service, so they were effectively dealing with the problem by only serving those who had the patience and time to wait for an hour or more. (After an hour, I was about to leave and try somewhere else later– the guard told me that the office serving downtown office workers tended to be quicker– but my number was called at last.)

I think the procedures of the SSA could be improved (for instance, it should have been possible to serve my request, and I suspect some other people’s, by mail rather than in person). But the most immediate problem that was readily apparent was that the office was underfunded. (The folks who were there seemed plenty busy to me, and not slacking off.)

Oddly enough, when I look at the people who tend to claim government agencies are “DMV-like” horror stories like I saw at the local SSA, and those that tend to favor underfunding them, they often seem to be the same people….

If the CEO compensation exceeds 40x the lowest wage in the company then Martin’s formula applies.

The DMV horror stories mostly predate computerization of these offices. The NY DMV was a nightmare in the 70s, mostly due to being underfunded due to state and local financial problems, and a purely manual filing and processing system for millions of people.

Just consider how much easier drivers licenses are now, with digital photos and cheap color printer/laminators. All the info is automatically pulled/entered into the DMV computer system.

Unsurprisingly, the Republicans can’t seem to keep up with modern times.

State ownership of important industries and the degree of control that comes with it is in the direction of socialism.

Let me put your mind at ease.

The government of the United States of America will avoid taking ownership of any significant industry in this country as long at it is conceivably possible for them to do so. The only thing that has ever induced them to do otherwise is the threat of the absolute collapse of the economy, and that is the only thing that will induce them to do so in the current circumstance.

Should they somehow be forced, kicking and screaming, into taking actual, meaningful ownership of any financial or industrial company, they will sell it back into the private sector as soon as they reasonably can.

I may be missing something, but I would say the feds are doing everything they can possibly do to avoid taking ownership of either the financial or the automotive industries, and where they have somehow ended up with a significant ownership stake, they have gone out of their way to avoid combining that stake with anything resembling hands-on executive direction.

Citibank’s total market capitalization right now is $5.64. It closed on Friday at $1.03 per share.

We’ve put many multiples of that into Citi so far in cash, and tens of multiples of that in guarantees. By rights, we should own Citibank 10 or 20 times over. I’m being conservative, maybe it’s more like 40 or 50 times over.

In exchange for direct cash payments and guarantees equal to a couple of dozen Citi banks, what meaningful form of ownership can the feds now show? When anyone from the federal government says “jump”, who at Citibank asks “how high?”.

Instead, the feds need to call the executives at Citi to make sure they won’t be too upset by any policy proposals the feds may be planning to roll out.

If you’re worried about the feds pissing your money away like a sailor on shore leave, I feel your pain.

If you’re worried about socialism, don’t lose any sleep over it.

the whole point of free-market capitalism is that employees are paid what they can get, not what they “earn”.

I’m not sure if that’s the ‘whole point’ of free-market capitalism, but it is absolutely one of the inevitable consequences of it.

Labor is provided by a labor market. Buyers and sellers of labor haggle and make their deal.

There may be, and perhaps ought to be, some meaningful relationship between what the providers of labor are paid and the value they create, but there’s nothing in the equation that requires that to be so. In either direction.

My question is: if the normal operation of the ‘labor market’ results in a situation where a significant number of people can’t live on their wage without some kind of external assistance, how is that anything other than a market failure?

“I know the progressives believe they have the electorate behind them on this issue, but if they are wrong?”

Fox News Poll, March 3-4, 2009:

Also:

From TPM:

There’s a lot more at the original poll folks might want to look into.

The shift of responsibility for universal healthcare to the federal level is an issue that should have extensive and very specific debate before any funding is committed.

The earliest proposal for federally provided health care that I’m aware of is Harry Truman’s, in 1945.

How much longer should we bat it around before we do something about it?

Coming late to this thread, but with notables like:

…you just gotta love the fluency with which hilzoy speaks Tongue In Cheek.

How about this? Tax based on rank order of income. However many filers there are, you make that many marginal brackets (perhaps including negative marginal rates at the low end). Set a maximum marginal tax rate of < 100%, and let the marginal rate decay approximately exponentially to the minimum marginal rate (I'm choosing exponential because some expression for the effects of habituation would suggest that returns to income might decline that way, but it isn't really important: for giggles, you could force the marginal rate through zero at median income). Sounds fun.

“My question is: if the normal operation of the ‘labor market’ results in a situation where a significant number of people can’t live on their wage without some kind of external assistance, how is that anything other than a market failure?”

Russell, markets cannot fail, they can only be failed.

Insufficient wages coupled with the appropriate degree of privation among some classes of people, could, without the need for external assistance, result in a properly functioning market. I shall dub this The Suffering For Thee Be Equity For Me Theorem, whose mathematical expression is as follows:

(IW+ADP)/SCP – EA = PFM

I would love to expound on this further, but a lorry awaits to take me to Monocle & Top Hat Depot, where I’ve heard a new selection of graven ivory cigarette holders are due this very morning.

And the galling thing to those who do not support a federal takeover of health services…

the strawman runs out of the room, screaming for his life.

“There may be, and perhaps ought to be, some meaningful relationship between what the providers of labor are paid and the value they create, but there’s nothing in the equation that requires that to be so. In either direction.”

“Value” is entirely subjective, so you’re asking for something which could never exist. Suppose you’ve got five people working on making something, they’re all performing necessary steps; How do you allocate the value of the product among them? Even assuming you had an objective value for the end product? And suppose the public doesn’t want to pay what you’ve decided the product is “worth”? Do you force people to buy it? Or pay the people the value of their labor out of thin air?

Thinking that “value” is some kind of objective measure of an object or activity, rather than just opinions of particular people, is a trap anybody who’s the least bit economically literate should never fall into.

Thinking that “value” is some kind of objective measure of an object or activity, rather than just opinions of particular people, is a trap anybody who’s the least bit economically literate should never fall into.

Nice sentiment but it conflicts with this

Heck, if they WERE doing it to be socially responsible, they’d offer me a discount to encourage me to go along with it, instead of insisting on capturing all the savings themselves.

There, you attacked the notion that there were values that were not captured economically, but now you are claiming that values are somehow socially determined by the public. While I’m sure that there is a middle ground, whiplashing back and forth between two poles is not the optimal way to present it.

“We are creating an income

taxdistribution system in which thetaxincomeburdenis falling more and more on a smaller group of people, while an increasing number arepayingseeing little or no incometaxgrowth. I don’t know if that’s a good idea.”I think that’s a little more reflective of the reality of the past eight years, if not longer.

Or, y’know, creeping socialism will doom us all and send the worldwide economy into a death spiral. Either or.

“We are creating an income

taxdistribution system in which thetaxincomeburdenis falling more and more on a smaller group of people, while an increasing number arepayingseeing little or no incometaxgrowth. I don’t know if that’s a good idea.”I think that’s a little more reflective of the reality of the past eight years, if not longer.

Or, y’know, creeping socialism will doom us all and send the worldwide economy into a death spiral. Either or.

“Value” is entirely subjective

If the question is something like ‘how much of the revenue from each car sold is created by the guy who bolts the doors on vs the guy who installs the rear window glass’, yes, I agree, that would be hard to measure.

That said, pretty much all business owners I know can put a reasonably good number on how adding or subtracting some number of staff will, net/net, effect their bottom line. Hard to see how they could make sane decisions otherwise.

In the context of the question on the table — when is compensation ‘obscene’ — if someone’s being paid tens or hundreds of millions of dollars per year to absolutely shatter the organization they’re running, and take a lot of the overall economy down with it, I’d call that obscene.

In a recent year, 5/6 of revenue at one of the major banks — I think it was either Citi, BoA, or Merrill — went to executive compensation. Five out of six dollars.

I’d call that obscene. It’s not their money.

I’d call that obscene. It’s not their money.

This gets to the heart of it: how we define “their” — or “my” from the point of view of the people complaining about tax increases — isn’t definable in absolutes, it’s contingent. (See for instance the discussion of ‘the commons” in a recent thread. See the question of who owns the air, fresh water, etc.)

In a way that’s hidden by the complexity of our economic system, our laws, and our society in general, people who have that much more money than an equal share, and that much more than anyone could possibly need for a materially comfortable life, have it because they’ve been greedy enough, and skilled and ruthless enough, to grab it.

I see the tax structure as nothing more complicated than the rest of us banding together to grab some of it back.

The fact that we then use a lot of it for the collective good (in the form of roads, teachers, police departments, DMV offices, etc.) is …well, let’s just say interesting.

“Suppose you’ve got five people working on making something, they’re all performing necessary steps; How do you allocate the value of the product among them?”

Simple: From each according to their abilities, to each according to their needs.

But really, that little word “necessary” cries out for further elaboration (who decides what is “necessary”, for instance)…sort of like defining “income” when debating taxation.

BB: “Value” is entirely subjective, so you’re asking for something which could never exist.

So much for truth, beauty, and the American way.

Bernard, I’m sorry: my html-foo isn’t what it used to be. I’ll see about providing a different link.

AW stands for average wage. As used here, it’s a measure of when the top bracket kicks in ….

Which goes directly to Tobie’s point regarding Table 1.1. That table measures total tax burden. Workers in the EU have a higher total tax burden because they pay taxes across the board (e.g., the top marginal rates kick in sooner … sometimes much sooner … than in the US).

And that’s part of my point. Obama’s combination of tax cuts and tax increases is not only shifting the (income) tax burden to the rich, but eliminating the income tax burden on the more and more folks. Nearly have (44%) of income earners under Obama’s plan will pay no income tax or actually receive income via the tax system (and effective negative tax).

Which is to say: the OECD figures support both my (related) points.

How does it compare to historic U.S. trends in income tax spread, Von?

I don’t know how to answer your question, Gary. If you look at the Revenue Act of 1932, you see a highly progressive income tax system albeit one in which everyone at every income paid taxes. (+ a 2%/4% SS payroll tax). Since that time, we’ve greatly simplified the tax brackets while making deductions/credits far more complex. We’ve also eliminated taxes on most low income earners (and some middle-income earners as well). For instance, under Bush, 38% of people pay no income tax and the rules for deductions/credits are enormously complex.

Obama largely continues this trend. Factoring in the stimulus package, Obama significantly increase the complexity of the credit/deduction regime while increasing the number of folks who pay no tax to about 44% of earners. The difference is that Obama shifts the burden more to the upper end of income tax payers, although it’s still below historical norms. (I think it’s this latter bit that you’re getting at.)

von – I’m curious about your focus on income taxes when making the point about tax burden on the lower end. As has been endlessly pointed out, FICA and Medicare taxes start at the first dollar of income and sales taxes, not to mention the effects of business tax cost shifting on prices, start at the first dollar spent and never cap. Why do only income taxes count?

Here is where you can download the e-book with OECD data where all the tables point to an underlying excel sheet.

I’m still trying to figure out what is wrong with having more lower income earners pay less tax in the current economy. Money put in the hands of lower income earners is more likely to be spent than saved because they are currently living at the margins and have no resources to fall back on. The taxing of the lower income brackets in Japan (specifically with a rise in the sales tax) was one of the main factors that ruined the stimulative effects of the massive Japanese intervention.

Bernard:

Here’s the OECD Tax Database. Table I.4 concerns top marginal rates, and is the basis for my comments. Table I.3, however, is probably the most interesting because it compares the tax policies that affect the majority of payers. I find “all in less cash transfers” to be the most useful basis for comparison when you’re focusing on joint filers (with or without children).

I think that you’ll conclude that the average US taxpayer is significantly below the typical EU taxpayer, while the top “all-in” marginal rates are pretty much within the norm (all under Bush).

The only real outlier under Bush is the AW multiplier to trigger the top tax rate (in Table I.4), and I suspect that this explains why folks in the EU tend to pay more in taxes. Many more people pay the top marginal rate in the EU than do in the US.

Nearly [half] (44%) of income earners under Obama’s plan will pay no income tax or actually receive income via the tax system (and effective negative tax).

the technical term for these people is “lucky duckies”

Nearly [half] (44%) of income earners under Obama’s plan will pay no income tax or actually receive income via the tax system (and effective negative tax).

the technical term for these people is “lucky duckies”

And the reason they pay no taxes — well, except for FICA and sales taxes, which Don’T Exist is because if we DID make them pay income taxes, they would have to stop eating or wearing clothes or living under a roof.

Yet it seems the question “Why are 44% of all earners so freakin’ poor that the mere cost of food, clothing, energy and shelter plus the state and FICA taxes they can’t avoid, leave them NO MONEY to pay income taxes?” is not to be asked.

Which of course was the point of someone’s question about income distribution — you can’t get blood from a stone, and you can’t tax the folks who — after paying for the necessities of life — have no money left.

Here is how the ‘soak the rich’ scenario looks to me.

Income above $250K will be taxed at not quite 40% instead of 35%.

Income above $250K *may* be liable to a 2-4% FICA tax.

Lifting the PEP and Pease deduction limits on upper income earners, which have been in place since about 1990, will not happen in 2010 as originally planned. Instead, the partial lifting put in place in 2006 will be reversed.

All of this will result in an increase in the federal tax burden of about 7-9% on income above $250K.

With the exception of the FICA change, this will be accomplished by letting Bush-era tax breaks for upper incomes expire, as was intended when they were written into law.

As an aside, those tax cuts were intended to expire because extending them was estimated to add $1.8 trillion to the national debt over the following 10 years. I’m guessing adding $1.8 trillion onto what is already going to be a truly stunning national debt is as bad an idea now as it was in 2001.

Nobody likes to pay higher taxes. So, yeah, it sucks that some folks taxes may go up. It is just one of the very, very many things that suck right now.

And yeah, wealthier people pay taxes at a higher rate than less wealthy people. Generally speaking. If the progressive nature of our tax regime is what bugs you, I can kind of see your point in principle, but as a practical matter it’s a not-bad way to spread the tax burden across the population.

We’re nowhere near socialism. We’re nowhere near a confiscatory tax regime.

Maybe there is some significant additional aspect to Obama’s tax proposals that I’ve missed. I’ve looked around a bit, and I think I have the gist of it, but I could be missing something. If so, let me know.

But from what I can see, I just really do not see a basis for a complaint.

What Morat20 said.

Also, debra started this thread with a spot-on point: “Words are rallying points, aren’t they?”

Hence, the sudden use of the word “socialism” coming out of every Republican politician who has a microphone in front of him/her.

They may not have a leader right now, save Rush — and it looks like Eric Cantor wants the job — but they certainly have a theme to pound into the American conscience, and they are doing a lot of pounding. Socialism. Socialism. Socialism. Obama the Socialist. Heck, he even adorns those Soviet-style posters.

As usual, the GOP can’t simply attack on the issues — they must distort and deride and distance themselves from the truth. President Obama is simply making hard decisions on hard issues that Bush took pass after pass on while we got on today’s bankrupt path.

The Great Recession — that occured on George Bush’s watch.

The Great Recovery — that will be Barack Obama’s and, frankly, I don’t give a sh!t if it has some socialistic flavor to it if it makes the United States of America a more prosperous place.

Morat20,

I am not in favor of anyone paying more taxes, especially the lower 44% of income earners. I do have a question though. At one time in my life I was stuck well down in this group and yet I can recall that I still had ample discretionary income to indulge a number of what I now view as bad habits and which I have ceased. Are you asserting that this group now can only meet the essentials of life and do not partake of the litany of non-essential but certainly life enhancing electronic devices produced by this evil capitalistic society? I am assuming that in their dire circumstances they would not waste resources like I did in my youth.

I’ll second GoodOleBoy’s comment to Morat20.

The question is not whether higher earners will have to pay more taxes. They will. What’s unprecedented in Obama’s plan is that high earners will pay more taxes while low and mid-earners will either pay no income taxes or get a tax cut. Even FDR’s (very) progressive tax system (the 1932 tas act) had everyone paying a share of the tax.

Good Ole Boy: You mean cigarettes and liquor? We tax those too.

GOB: Are you saying someone living in poverty or, for that matter, just above the poverty line is not allowed to have a bad habit?

And what about all those schmucks living in poverty? What do you propose we do with that segment of our population?

Can we PLEASE stop pretending it’s “unprecedented” for the rich to pay taxes? Pretty please? And please stop pretending that people “don’t pay taxes” when they pay federal and state taxes on everything they buy, Medicare and Medicaid taxes, Social Security taxes, and all the rest, not to mention the “poor tax” that comes in the form of extra deposits, higher fees, etc from phone companies, electric companies, banks, and all these others that use credit checks?

Seriously, this “OHNOES UNPRECEDENTED TAXING!” is beyond ridiculous. The people who are being asked to pay more money now are people who made out like bandits over the past 8-20 years, and in many cases helped put the economy in the crater it’s in.

Who is doing that, besides you?

I suspect that much of the difference in views expressed here results from a different view of what constitutes life essentials. Each of us likely takes this from the formative years of our lives. My children and grandchildren I’m certain define this differently from the way I do. During the recent national campaigns the frequent statements by candidates when making campaign promises about what the government was going to do for people would include the phrase ‘these people are struggling’. I would say to myself, ‘well, yeah, that’s what life is about’. Perhaps one of the distinctions between the generations is that most people in mine struggled from the beginning and many in the later generations experience the struggle as a sudden trauma for which they are unprepared. I have spent my life giving thanks for having been born in America with not much else but the chance to improve. I marvel every time I consider how much success our society has had over my 70+ years in raising the standard concept of what constitutes life’s essentials.

von said “What’s unprecedented in Obama’s plan is that high earners will pay more taxes while low and mid-earners will either pay no income taxes or get a tax cut. Even FDR’s (very) progressive tax system (the 1932 tas act) had everyone paying a share of the tax.”

Everyone still pays a share of the taxes. The Bush tax cuts will be allowed to expire. The “low and mid-earners” who “will pay no income tax” are the same people who have spent years watching their incomes stagnate while whatever profits there went to the tiniest fraction of the top bracket. But hey, the real problem here is semantics and the return of Clinton era taxes on the rich. Feh.

about that 44%…

in 2006, the median personal income was $32K.

therefore those lucky duckies in the 44% are probably making somewhere below $30K/yr. again, this was in 2006, when the economy wasn’t a disaster.

At one time in my life I was stuck well down in this group and yet I can recall that I still had ample discretionary income to indulge a number of what I now view as bad habits and which I have ceased.

hell yeah. i remember enjoying life when i was just out of college, making $30K. best years of my life, in many ways! i had a $400/mo apartment in a crappy neighborhood, and i split expenses with my girlfriend. it was also 1994.

Are you asserting that this group now can only meet the essentials of life and do not partake of the litany of non-essential but certainly life enhancing electronic devices produced by this evil capitalistic society?

Many personal electronic devices are not necessities but are net time or money savers. That means that going without these devices may not increase the amount of money one has. A cell phone is not a necessity, but if you’re trying to get a job and you don’t have a fixed address, having one makes it much more likely that you’ll be able to gain employment. A cheap video game console and TV might seem like a luxury to you, but people need to relax and if it displaces more expensive forms of relaxation and socialization like going to the movies or hanging out in a bar, it is a clear win.

When I lived in poverty into which I was born, I don’t have any recollection of being taught or thinking that someone else beyond my family and myself was going to do something to change that state. The life struggle was my challenge and I was lucky enough to be born in a country and a society in which I had the freedom to ‘do’ things that ultimately enabled my upward movement from the conditions of my birth. When I was a child, even though we had little, my family always pointed out to me how much better off I was than many in the world because I would have a chance to change things.

Yes, the bad habits, beer and cigarettes, were taxed back then, too. And I even had money to spend beyond that, and I don’t ever recall having an expectation that the government was going to mitigate my financial condition and pay some of my bills. I would have to do some digging to check, but I think I even paid income tax when I was well ensconced in that lower 44% of earners. But expectations do get raised.

What’s unprecedented in Obama’s plan is that high earners will pay more taxes while low and mid-earners will either pay no income taxes or get a tax cut.

I’m assuming you’re talking specifically about *income* tax. As others have pointed out, there are a number of other taxes that are either flat or actually regressive.

It is not only not unprecedented, it is quite normal for folks who make below a certain income to end up paying no income tax.

When this happens it is not because they are exempt from income tax. If you make $1.00 a year, you owe ten cents of that to uncle.

Folks who end up paying no income tax do so because whatever deductions or other adjustments they can claim bring their taxable income below $0.00.

This has been true more or less for as long as we’ve had an income tax. Or at least as long as there have been any deductions.

Is the tax code a big ugly pile of spaghetti? Yes it is.

Did Obama cause this? No, he did not.

The whole conversation about this is approaching the comical.

Obama is proposing, basically, a return to the tax structure we had prior to Bush’s tax cuts of 2001, which were already scheduled to expire in a year or so. There *may* also be a small FICA tax imposed on income above a quarter million bucks. “Small” here is 2 to 4 percent.

As far as I can tell, those are the proposals on the table. They are, both in absolute and in historical terms, modest.

Do you disagree?

Yes, he’s not *also* increasing taxes on lower income folks, and in fact would like to reduce them for many folks.

If you’re a lower-income person, looks like it’s your turn this year. Lucky you.

How do y’all account for the fact that the US poverty rate has hovered around 12%-15% since 1965 even though trillions of dollars have been transfered downward as part of the war on poverty? Doesn’t it seem like it’s not working?

Is it possible that there is a certain percentage who will spend some time in poverty no matter what you do for them? For example, every new generation has it’s share of addicts, unwed mothers, mentally ill and disabled. I have my Norman.

I’m not advocating that poverty is good nor that we shouldn’t have programs to help them. I’m just suggesting that eradicating poverty entirely is unlikely. The goal should not be elimination of it IMHO but making sure there is a safety net. And there IS a safety net.

We’d have to do something different to find out.

JanieM says: “I see the tax structure as nothing more complicated than the rest of us banding together to grab some of it back.”

Exactly. Since there are long established property rights that you cannot overturn by action of legislation or recourse to the courts because such laws are among the founding principles you instead are resorting to the tax code to implement your subversive purpose.

I remember back when Republicans were busy demonizing welfare recepients: the conversations about how a single mother could support her kids if she just stopped getting her hair done or drove a used car instead of the imaginary welfare Cadillac. Meanwhile timber industry workers and cattle ranchers continued their parasitism on the taxpayer, supported by Republicans in Congress, with no critisisms about spending too much on off road vehicles or chewing tobacco.

It’s standard procedure to denomize and trivialize people in order to justify screwing them.

It is even worse to demonize and trivialize one group of people in order to protect the privleges of an elite!

Most of my clients are poor and might, in someone’s estimation, waste some of their meager resources on some minor pleasures for their lives. I don’t give a shit because it is not relevant to the issue under discussion here.

The issue is are those with incomes at the level to make them people who matter to Republicans so special and wonderful and superior to everyone else that they should be protected from a minor tax increase during an economic crisis caused in large part by bad decssions made by rich people in business and Congress or regulatory agencies?

I mean, if the people with incomes above 250,000 are so inately superior as to be considered the producers and innovators,The People WHo Should Not Be Taxed Lest They No Longer Produce, how come the economic FUBAR we are facing now was created entirely by members of that class? Poor people wasting money didn’t create this mess. Members of and representatives of a wealthy elite did. Which makes the assumptions about the inherent superiority of that class’s contributions to our economy look pretty shakey to me.

“Simple: From each according to their abilities, to each according to their needs.”

I believe history has shown that this doesn’t work. Why do you cling to it? Is it because your needs outstrip what your abilities can provide? There’s a safety net for you. Advocating for you to receive more than the safety net is a violation of the the principle you espouse in that you are asking for more than your needs.

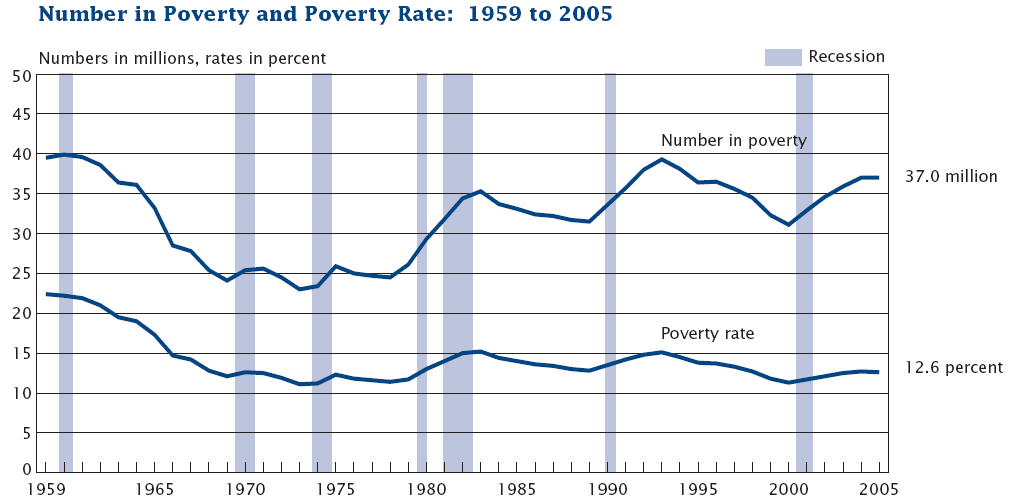

How do y’all account for the fact that the US poverty rate has hovered around 12%-15% since 1965 even though trillions of dollars have been transfered downward as part of the war on poverty? Doesn’t it seem like it’s not working?

That would depend on the rate previously since the rate in 1959 was about 22%, I would say that it may very well be working From wikipedia:

hmm, the image gets truncated at least in FF.

Image here

Article here

“I’m just suggesting that eradicating poverty entirely is unlikely.”

Actually, eradicating poverty entirely couldn’t be more simple: just give poor people enough money. If you give everyone who can’t earn as much, say, $20,000 a year, no one will be poor.

You may have various objections to this notion, but I’m curious to know why you might think it wouldn’t eradicate poverty.

“There’s a safety net for you. Advocating for you to receive more than the safety net is a violation of the the principle you espouse in that you are asking for more than your needs.”

Spoken by someone who hasn’t fallen on that “net” in the last twenty years, and noticed that it’s as much holes as net.

“Simple: From each according to their abilities, to each according to their needs.”

I believe history has shown that this doesn’t work. Why do you cling to it? Is it because your needs outstrip what your abilities can provide? There’s a safety net for you. Advocating for you to receive more than the safety net is a violation of the the principle you espouse in that you are asking for more than your needs.

I’m not sure I get the quote above in its original context, but the original context, none the less, had nothing to do with whatever it is dave seems to be arguing against with some imaginary “you” over some imaginary position.

Gary,

That was Charles Murray’s proposal, but I think he favored giving the sum to all adults and maybe even mandating how some portions must be spent, like for healthcare. This might work. I would like to see a good discourse that debunks the proposal, if one exists.

Is it possible that there is a certain percentage who will spend some time in poverty no matter what you do for them?

I’d put the odds at somewhere between ‘highly likely’ and ‘inevitable’.

I’m not aware that ‘eliminating all poverty’ is the goal of Obama’s tax proposals.

The point of hilzoy’s post is that claims that Obama’s tax proposals amount to ‘socialism’, or even a dramatic departure from typical adjustments to the tax schedule, are kind of risible.

I agree with her.

243: you chart reinforces my point that since the war on poverty was established formally by LBJ in 1965 there has been no significant change. Talking about poverty in 1959 is no more relevant to that point than talking about how everyone in the stone age lived in poverty.

Would it be stupid to look at historical murder rates to decide whether or not murder should continue to be a crime? Just asking.

//You may have various objections to this notion, but I’m curious to know why you might think it wouldn’t eradicate poverty.//

Because Norman, and people like him, would blow their subsidy on drugs the minute they get it. They would have nothing left for food, housing, clothing, etc.

I’m not saying every poor person is like Norman but there are many. For these people, putting money in their hands is not the cure. They need a mommy to actually follow them around and make sure they don’t do stupid things. She needs to make sure they eat properly, don’t hang out with the wrong people, go to bed on time, just basic stuff that most people learned when they were children. Providing such a mother for each of them would cost more than $20k plus various lifestyle advocates would sue on behalf of the Normans saying their lifestyles are an acceptable alternative. Either way, poverty would remain to some extent.

you chart reinforces my point that since the war on poverty was established formally by LBJ in 1965 there has been no significant change.

Dave, you will notice I said that it “may” be working. One problem is that the chart doesn’t show enough pre-1965 data to show what the trends were then. It could be that 1959 was a one time anomaly and that prior to that the poverty level had hung around the same level as it now, or that the it was greater, or had greater swings. I don’t know, however we do know that post war on poverty we haven’t seen it climb to its previous height(s).

“Simple: From each according to their abilities, to each according to their needs.”

I believe history has shown that this doesn’t work.

Wrong. In theory, the USSR adopted this as ‘from each according to his ability, to each according to his work’. ‘To each…needs’ remains Marx’s powerful ethical ideal.

“Simple: From each according to their abilities, to each according to their needs.”

Is there any possible way to square a notion like this with the concepts embodied in the United States’ founding principles? I think not.

Hairshirt at 2:35p

//I’m not sure I get the quote above in its original context, but the original context, none the less, had nothing to do with whatever it is dave seems to be arguing against with some imaginary “you” over some imaginary position.//

My 2:14p comment was responding to bobbyp at March 09, 2009 at 09:21 AM. That was the context. He was the imaginary ‘you’.

If you’re going to jump into the middle of the conversation then please be aware that you may not be aware of the context.

‘To each…needs’ remains Marx’s powerful ethical ideal.

it’s a Biblical ideal, even.

“This might work.”

The negative income tax.

Well-known communist Milton Friedman.

“Because Norman, and people like him, would blow their subsidy on drugs the minute they get it. They would have nothing left for food, housing, clothing, etc.”

That’s another problem, but it wouldn’t be a problem of poverty.

“They need a mommy to actually follow them around and make sure they don’t do stupid things.”

That’s true. People who are very poor are poor for reasons, and not, in most cases, reasons of choice.

They’re poor variously because of mental illness, emotional illness, physical illness, dependencies of one sort or another, dependencies of others upon them, lack of skills, lack of knowledge, lack of knowledge of appropriate behavior, lack of self-control, lack of intelligence, and so on and so forth.

And so many people do need help beyond simply being handed a stack of bills.

So I wouldn’t argue that a negative income tax is a cure-all. There still need to be mental health services available, physical health services available, child care, and anything else necessary to help people gain the tools they need to survive and get ahead, or to enable people to at least not suffer.

But making sure they have enough minimal money not to be poor would be a huge start.

And it would wipe out poverty: just not everyone’s problems. But I certainly agree that wiping out everyone’s problems isn’t on the horizon.

I’m happy to settle, though, for wiping out povery, and making available the tools for more or less everyone to survive adequately. (And, yes, that includes allowing for a certain amount of relaxation/stress-relief/entertainment, which is a necessity for mental and emotional health.)

russell, 2:40p

//I’m not aware that ‘eliminating all poverty’ is the goal of Obama’s tax proposals.//

I agree. That has not been Obama’s stated goal. My comments about the success of the war on poverty were a response to one or two comments up thread which loosely argue that the rich who favor lower taxes must want poverty because higher taxes fund transfers to poorer people which ends poverty.

How is that for a poorly written run on sentence?

I do get that part, dave. I didn’t really understand how bobbyp was applying “Simple: From each according to their abilities, to each according to their needs.” to the determination of the value of, say, an assembly line worker’s output. That’s the context I didn’t get. I just think you’re taking that quote and putting into a much broader and different context than in bobbyp’s comment. He’s an imaginary “you” because I don’t see where he made an argument remotely resembling the one you seemed to be addressing. And it’s a blog. Jumping in on a conversation is what it’s about.

“Simple: From each according to their abilities, to each according to their needs.”

Is there any possible way to square a notion like this with the concepts embodied in the United States’ founding principles? I think not.

This sort of abstraction of the discussion at hand annoys me because it has nothing to do with the specific numbers 35 and 39.6. Are we arguing over progressive taxation in general, or addressing the point that the new marginal rate is nothing new or historically anomalous or outrageous?

I’m not actually endorsing the notion, but I’m not seeing how it’s incompatible with the idea of unalienable rights to life, liberty, and the pursuit of happiness. In fact, it seems to fit pretty well with it.

I don’t see how it makes sense to muddle the “founding principles” with ideas about capitalism and communism that weren’t developed until after the founding occurred.

Cleek

//It’s a biblical ideal, even//

First, something that occurred in the bible is not necessarily a biblical ideal. Second, the early christian church as portrayed in this passage of Acts had a characteristic that made this practice work for them. It is a characteristic that CANNOT work in a more heterogenous population. It was this:

“the multitude of them that believed were of one heart and of one soul: neither said any of them that ought of the things which he possessed was his own; but they had all things common.”

One heart and one soul cannot be legislated. It is a voluntary thing.

The only place in the Bible I am aware of where an ideal civil economy is described is in the book of Joshua where land was partitioned more or less equally among families and a system was instituted whereby land could not be sold permanently but only leased for the period up to the next jubilee. This basically enabled one generation to do something stupid but all was put back to more or less even every 50 years.

hairshirt

//He’s an imaginary “you” because I don’t see where he made an argument remotely resembling the one you seemed to be addressing.//

I see. Fair enough.

First, something that occurred in the bible is not necessarily a biblical ideal.

it is Biblical in the sense that the source of the phrase is the Bible, and the idea which the phrase embodies is from the Bible. i’m obviously not implying that Jesus was preaching communism.

hairshirthedonist at 2:35:

And it’s a blog. Jumping in on a conversation is what it’s about.

hairshirthedonist at 2:39:

This sort of abstraction of the discussion at hand annoys me because it has nothing to do with the specific numbers 35 and 39.6. Are we arguing over progressive taxation in general, or addressing the point that the new marginal rate is nothing new or historically anomalous or outrageous?

It’s a blog. Expanding, contracting, deflecting, ignoring, and in general addressing the original topic as creatively and/or annoyingly as possible is what it’s about. 😉

By the way, although I’m in favor of a negative income tax (which would replace existing welfare programs – Gary Farber provides the links), the negative income tax is not relevant to the current discussion.

Drat! JanieM wins.

“243: you chart reinforces my point that since the war on poverty was established formally by LBJ in 1965 there has been no significant change.”

I don’t know what chart you’re reading, but the posted chart says this: the percent of Americans living in poverty in 1965 was approximately 17%.

By 1970, after Johnson passed a chunk of his “War On Poverty” bills, the percentage of Americans living in poverty had declined to approximately 12%.

Over six million fewer Americans were living in poverty, and that’s including the absolute rise in population.

How is this insignifcant?

Under Nixon and Ford’s “benign neglect” of poverty programs, the poverty rate stagnated.

In a stunning surprise, after Ronald Reagan was elected, the poverty rate rose again, from that approximately 12% to a shade over 15%, a jump of some 25 million Americans, to over 35 million Americans. There was a small decline then under his presidency, down to about 32 million.

Then a sharp rise in numbers under G. H. W. Bush, and then after Bill Clinton was elected, a drop from around 39 million to around 32 million.

How is all this insignificant?

“…36.5 million people (approx 1 in 8 Americans) were below the official poverty thresholds in 2006, compared to 31.1 million in 2000[14], and that there was an increase of 4.9 million poor from 2000 to 2006 while the total population grew by 17.5 million.”

That’s a lot of people. But maybe they all are just lazy, and the undeserving poor.

“Is there any possible way to square a notion like this with the concepts embodied in the United States’ founding principles? I think not.”

I’m curious, as a side issue, which specific founding principles, found in which specific documents, you have in mind.

Goodness. Thank you, Cleek.

Gary,

Top of head, but I think it is squareable with the following:

Declaration of Independence

1. Life

2. Liberty

3. Pursuit of happiness

Preamble to the Constitution

1. More perfect union

2. Establish Justice

3. Ensure domestic tranquility

4. Promote the general welfare

5. Secure the blessings of liberty, to ourselves and our posterity.

The only place in the Bible I am aware of where an ideal civil economy is described is in the book of Joshua where land was partitioned more or less equally among families…

I think the relevant civil law is spread across a couple of books, but this is essentially correct. The only place where specific, detailed rules for civil economy are laid out are those specified for the nation of Israel in its early days.

The topic of how the poor should be treated, however, comes up frequently in the Bible. By “frequently” I mean “everywhere”.

Nor is there much private vs public distinction on the topic. Individuals, societies, and governments are all held to account for how they treat the poor and powerless.

If what the Bible says is something you’re inclined to be concerned about, it’s something that really ought to jump right out at you.

Other than the civic obligations laid out for the nation of Israel in the Pentateuch, the only discussion that comes to mind on taxes per se is “render unto Caesar what is Caesar’s”.

I still think the OECD Data is far trickier than you think, von. One thing it doesn’t take account of is income distribution. According to the Wikipedia entry on the Gini Coefficient, which is the formula used to measure income inequality, the US is in the same category as Mexico when it comes to income distribution. The gap between rich and poor is far greater here than in Canada, Western Europe, Japan, etc. So, given that there’s more income inequality here, it also stands to reason that the 2% of the population earning the majority of the $$ in the US (maybe as much as 60%)would also have a larger share of the tax burden. Countries with more income equality don’t have to vary rates so much.